The real estate market has been a proven avenue for individuals looking to build and diversify their wealth for decades. An investment property, distinct from your primary residence, serves as a source of income—rental income, capital appreciation, or both.

As with any investment, purchasing a property requires due diligence, preparation, and a thorough understanding of the intricacies involved. Before venturing into this form of real estate investment, it’s essential to grasp the differences between buying a house for personal use and one for investment purposes.

Your Financial Readiness

Before diving into investment properties, assessing where you stand financially is the first step. It will largely determine the types of property you can afford, the financing available, and the potential return on your investment.

You must ensure your existing financial capacity can maintain or upgrade the investment property. Unforeseen expenses, like emergency repairs or sudden property tax hikes, can arise. Being financially sound will prevent such unexpected costs from crippling your investment.

Analyzing Your Current Financial Situation

You must review your tax returns, monthly payment commitments, and credit report. Understand your debt to income ratio to ensure regular cash flow, especially when considering monthly mortgage payments and rent payments. Determine if the passive income from the rental homes will be a significant source of income for you.

Determine Your Budget and Available Funds

Real estate investors must set a clear budget. It involves considering your equity loan options, evaluating mutual funds or other investments, and understanding your potential cash return.

Having cash reserves or an emergency fund for unforeseen costs is also advisable. Additionally, be aware of potential tax implications, which might require consultation with a tax professional.

Similarly, it’s vital to understand any state-specific tax incentives or deductions available for property investors. These incentives can offer significant savings, further increasing your investment’s profitability.

Assess Your Credit Score and Financial Stability

A satisfactory or high credit score is necessary when approaching mortgage lenders. Some investment property loan programs have minimum credit score requirements.

Regularly checking your score and addressing any discrepancies can significantly affect the mortgage rate you receive. Consider signing up for a credit-scoring agency that can help regularly monitor it for you.

Explore Your Financing Options

From conventional loans offered by mortgage companies to private loans, many options can be tailored for real estate property investments. The financing terms can vary depending on the type of investment property. It can be a residential, commercial, or multi-family home property.

If you choose Fannie Mae, familiarize yourself with the guidelines and understand the difference between investment property mortgage rates and conventional mortgages. Online lenders, community banks like U.S. Bank, and institutions like Bethpage Federal Credit Union offer different options for investment property funds.

When securing financing, thoroughly understand the loan’s terms and conditions. Factors like interest rate adjustments, prepayment penalties, or balloon payments can significantly influence your investment’s long-term manageability.

Understand the Costs Involved in Purchasing an Investment Property

Apart from the initial investment, various extra costs come with buying an investment property. These include:

- Down Payments and Mortgage Options: Typically, investment properties require a larger down payment than primary homes. Moreover, payment requirements might differ based on the property type—single-family homes, office buildings, or two-to-four unit properties.

- Property Taxes, Insurance, and Maintenance Expenses: Property values and taxes fluctuate. Insurance costs can also vary based on the type of property and its location. Maintenance costs must also be factored in, from routine tasks to unexpected repairs.

- Mention Other Costs: There are ancillary services to consider, like hiring a property management company. Additionally, there might be costs related to house flipping if that’s a chosen avenue or expenses linked to multi-family homes or apartment complex management.

The world of real estate investment is vast, including everything from “house hacking” in multi-family homes to managing office space for business purposes. As with any investment, it’s crucial to be informed, prepared, and guided by professionals.

To get the best out of your investment, consider consulting the expertise of a local eXp Realty agent. Contacting their agents will make your investment journey seamless.

It’s essential to remain adaptable. Market dynamics can shift, and staying flexible allows you to modify strategies, ensuring your investments remain profitable despite changing circumstances.

The Real Estate Market

Navigating the vast real estate market area requires research, foresight, and an understanding of local rules. As an investor, discovering prime locations, understanding market dynamics, and expected demand for different property types can significantly impact your returns.

Whether you’re contemplating single-family homes or commercial investment properties, a keen eye on the market’s pulse can make all the difference.

Identify Profitable Locations

Before investing, it’s essential to determine the locations that offer the best return on investment. Exploring the housing market trends of specific areas by checking resources with eXp Realty.

Regions with emerging employment opportunities, infrastructure development, and positive net migration often indicate growth and promise for real estate investors.

Examine Market Trends and Growth Potential

Staying informed about breaking news related to the real estate sector and analyzing historical data can provide insights into future resale potential and long-term appreciation.

You can make informed decisions by recognizing patterns and understanding factors affecting the real estate market, such as interest rates, economic indicators, and political stability.

Consider Local Amenities and Attractions

The value of an investment property is often directly influenced by how close it is to important amenities such as schools, hospitals, shopping centers, and recreational areas. Office buildings near transit hubs or retail space in bustling districts can mean higher rents.

Consider the potential future developments in these areas. Infrastructure upgrades, like new highways or public transit systems, can drastically increase property values and appeal over time.

Understand the Property Types and Their Demand

Different property types cater to various segments of the market. Single-family homes attract families looking for a community vibe, while multi-family homes can be lucrative in student-populated areas.

On the other hand, commercial properties require a keen understanding of business needs and trends. You can align your investment goals by identifying the types of property in demand in a particular area.

Evaluate the Rental Market and Potential Tenant Pool

A thriving rental market is a key indicator of a location’s investment potential. Look for areas with low vacancy rates, consistent cash flow, and a sizable tenant pool. Understanding the demographics, such as young professionals, students, or families, can guide investment properties.

Keeping a pulse on evolving tenant preferences, such as the increasing demand for remote-work-friendly spaces or sustainable living features, can position your property as more attractive in a competitive market.

Your Investment Strategy

Crafting a robust investment strategy is akin to plotting a map for your real estate journey. The roads you take, the destinations you aim for, and the paths you avoid are all predetermined by the objectives you set. Whether you’re leaning towards a quick flip, long-term hold, capital gains, or consistent rental income, your strategy will govern every decision.

Set Clear Investment Goals

The foundation of any sound investment strategy is a clear vision of what you hope to achieve. Do you seek a regular income stream? Potential investment property with hopes for future appreciation?

By defining your financial goals, you can channel your efforts in the right direction through house flipping, renting out residential properties, or exploring commercial real estate.

Short-Term vs. Long-Term Investments

While short-term investments, like house flipping, offer the allure of quick returns, they come with their challenges, such as a lack of liquidity and higher borrowing costs.

Long-term appreciation might involve holding onto a property for several years, banking on its future resale value and capital gains. Both avenues have merits and require different skill sets and risk tolerance levels.

Capital Appreciation vs. Rental Income Focus

Some real estate investors’ primary attraction is the prospect of capital appreciation, where the property’s value grows over time. In contrast, others prioritize a steady stream of rental income.

The latter ensures a regular cash flow, while the former is more speculative, banking on future property values. Understanding the rental property market and tenant demand in your desired location is crucial if monthly rent payments are prioritized.

Determine the Optimal Investment Property Type for You

The range of investment property types is vast, from single-family homes and multifamily units to office buildings and retail spaces.

Your choice should resonate with your investment goals, budget, and expertise. For instance, managing an apartment complex differs vastly from overseeing a vacation rental or office space.

Assess Risk and Return Profiles

Every type of investment property comes with its risk and return profile. While commercial properties offer higher rents, they could also face more extended vacancy periods. Residential properties might have more consistent demand but may require more hands-on management. Thoroughly analyze the pros and cons, and weigh them against your risk appetite.

Factor in Personal Preferences and Expertise

Real estate investment isn’t solely about numbers and percentages; it’s also about what you feel passionate about as an individual investor. If you have experience in the hospitality industry, venturing into vacation property might be up your alley.

Those with a knack for remodeling might find house flipping appealing. Ensure your investment aligns with areas you are knowledgeable and passionate about.

Continuously educate yourself. Whether through workshops, online courses, or seminars, staying updated with industry trends ensures you remain ahead of the curve, optimizing your strategy for maximum returns.

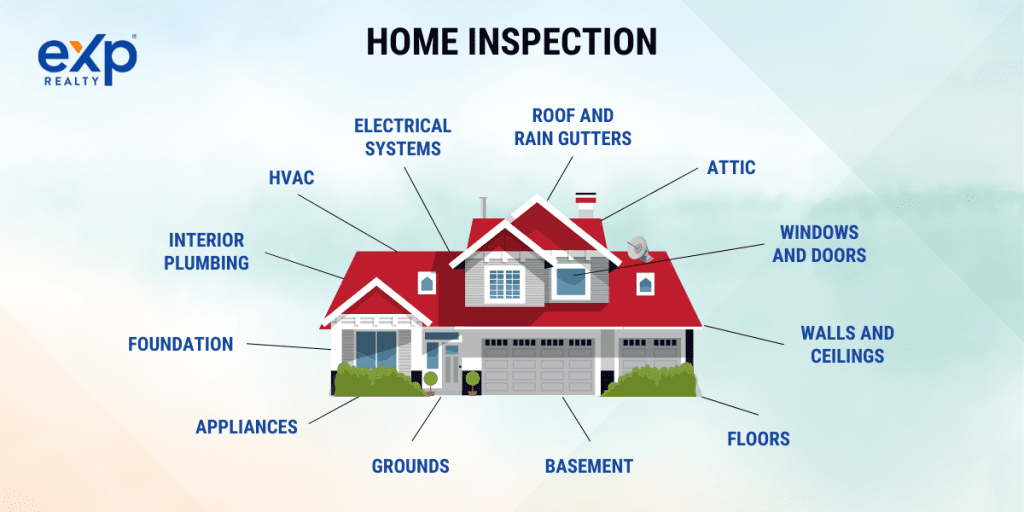

The Importance of Conducting Thorough Property Inspections

Delving into the world of real estate investment, one quickly learns that only some things are as it seems on the surface. A property might appear impeccable from a distance, but on closer examination, underlying issues can surface, affecting its value and potential as an investment.

It underscores the importance of comprehensive property inspections to ascertain its condition, worth, the surrounding environment, and potential future implications.

The Need for Professional Home Inspections

Engaging the services of a professional home inspector is not just a mere formality in the property acquisition process; it’s a necessity. These experts explore deeper than surface aesthetics, analyzing every nook, cranny, and hidden corner.

By doing so, they provide a reliable source of information regarding the actual property condition, ensuring that you don’t encounter surprises down the line as an investor.

Unearthing Structural or Maintenance Issues

Some problems, like a leaking faucet, might be obvious during an initial walkthrough. However, more severe issues such as foundational cracks, roofing problems, or outdated electrical systems can lurk unseen. Identifying these problems early on can save a potential property owner from heavy future expenses and safety concerns.

Assess Property Value and Future Repair Costs

Beyond the purchase price, understanding potential repair and maintenance costs is vital in determining the actual value of an investment property. Will there be immediate repairs needed? What might future maintenance look like? All these considerations directly impact your return on investment and monthly cash flow.

Evaluate Neighborhood Conditions and Property Surroundings

Beyond the four walls of a property, the broader environment plays a crucial role in its attractiveness to tenants and long-term appreciation potential. Elements like crime rates, the quality of schools, proximity to transportation, and local amenities can significantly impact property values and rental potential.

Consider the noise levels, community engagement, and general ambiance of the neighborhood. A peaceful, active community can be a significant draw for potential tenants, increasing the property’s desirability and, by extension, its rental income potential.

Future Development Plans and Potential Impacts

You must know any future development plans near your potential investment property. Whether it’s the construction of a new shopping complex, road expansions, or the establishment of a manufacturing unit, such projects can drastically affect your property’s value—either enhancing its appeal or diminishing it.

Other Considerations

As with any significant investment, the details matter. It’s prudent to consider property taxes, insurance costs, potential natural hazards, and a property’s historical significance.

Consider the sustainability features of the property. As more tenants become environmentally conscious, properties with green certifications, energy-efficient appliances, and sustainable design features can command higher rents and enjoy increased demand.

Legal and Regulatory Considerations

Acquiring an investment property isn’t just about scouting locations or determining return on investments. It is also about navigating the intricate web of local laws, regulations, and potential tax implications.

Overlooking these legal and regulatory aspects can lead to unexpected complications, so a thorough understanding and appropriate consultation is essential. From rental property guidelines to the nuances of landlord-tenant relationships, here’s what you need to keep in mind.

Familiarize Yourself With Local Laws and Regulations

Every region, city, county, or state can have regulations concerning investment properties. Before plunging into an investment, you need to be well-acquainted with these. Issues like zoning laws can impact what you can do with your property.

For example, can you convert a single-family home into a multi-family unit? Or is your commercial property zoned for both retail space and office space? Understanding these local regulations is paramount to ensure your investment is viable and compliant.

Some regions may have environmental sustainability or energy efficiency regulations, dictating the type of modifications or constructions permissible. It could influence decisions on renovations or upgrades. A property might seem ideal, but it can result in unforeseen costs and complications if it doesn’t meet these stipulated standards.

Rental Property Regulations, Zoning Laws, and Permits

Whether you’re eyeing a residential or commercial property, you need to be clear on the regulations surrounding rentals in that area. Before renting a property, some locales require permits. Others might have strict guidelines on safety standards, occupancy limits, and even the amount of rent that can be charged.

As the global emphasis on sustainability grows, certain areas are introducing green building codes and rental standards. Before renting out, landlords might need to invest in eco-friendly modifications. Not being compliant can attract penalties or even legal challenges from tenants.

Landlord-Tenant Rights and Responsibilities

Being a property owner doesn’t just come with benefits but responsibilities. Familiarize yourself with both the rights you have as a landlord and your tenants’ rights. These include eviction procedures, maintenance responsibilities, deposit regulations, and more.

In certain regions, landlords might need to provide tenants with information on energy consumption or the property’s environmental impact. The era of digitalization also brings forth regulations on data protection and privacy, especially if landlords are using digital platforms to manage rentals or interact with tenants.

Consult with Legal and Tax Professionals

Navigating the legal landscape of real estate can be intricate. It is where legal and tax professionals come in. They can offer guidance on contracts, agreements, and other legal documentation required for your investment property. Plus, they can clarify tax implications, deductions, and other financial intricacies, ensuring your investment remains profitable and compliant.

Legal professionals can advise on emerging legal trends or shifts in property rights, giving you a proactive edge. With evolving real estate laws, staying ahead can save time and money. On the taxation side, annual changes to tax laws can affect investment property owners, making the role of a tax professional invaluable.

Understand Tax Implications and Potential Deductions

Owning an investment property has a direct impact on your taxable income. From the rental income you earn to the expenses you can deduct, understanding the tax implications is essential. Moreover, specific tax incentives or deductions might be available for landlords, such as depreciation or maintenance costs.

Keeping a detailed record of all property-related expenses can prove beneficial. In some instances, costs like property management fees, travel expenses related to property management, or even interest on loans taken for property-related purposes might be deductible. However, it’s vital to seek advice as it can lead to severe tax consequences.

Key Takeaways

Diving into the area of real estate and investment properties can be both exciting and intimidating. From the initial financial planning to understanding the legalities of everything requires detailed attention and care. As we conclude our understanding of this endeavor, let’s revisit the main points every potential real estate investor should consider and think about.

Before you even consider looking at a property or browsing listings online, you must have a solid understanding of your financial standing. It includes knowing your credit score, exploring diverse financing options, and being aware of the costs accompanying property investment— down payments, property taxes, or routine maintenance expenses.

Investment isn’t just about buying property—it’s about buying the right property. Researching market trends, identifying profitable locations, and gauging the demand for various property types can make all the difference between a profitable venture and an uphill struggle.

Are you in it for the long haul, eyeing long-term appreciation? Or is your focus primarily on immediate rental income? Your investment strategy will significantly influence the type of property you should consider and the risks you’re willing to take to achieve your investment goals.

Always remember the power of a thorough property inspection. Beyond revealing potential structural issues, it can provide insights into the neighborhood, future development plans, and other factors influencing your property’s value and appeal.

You must address regulations, laws, and tax implications. Compliance in these areas safeguards your investment and can also provide potential tax benefits and deductions.

Every facet of real estate investment hinges on being well-informed. Whether through comprehensive research, consulting professionals, or leveraging resources like eXp Realty’s property listings, ensuring you have the correct information at your fingertips is crucial.

Real estate investment isn’t a mere transaction; it’s a journey. And, like all journeys, preparation and knowledge will be your most trusted allies. If you’re ready to embark on this adventure or want more professional insights, contact a local eXp Realty agent who can guide you through every step.

FAQs: Investment Property

Real estate investment is a multifaceted venture, and as with any investment, it’s only natural to have questions. This section will address frequently asked questions about investment properties, ensuring you have the clarity you need as you embark on or further your investment journey.

What is the 2% investment property rule?

The 2% rule is a guideline that some real estate investors use to determine whether a rental property will generate a good return. According to this rule, the monthly rent of a property should be at least 2% of the property’s purchase price.

The monthly rent for a property purchased at $100K should ideally be $2,000. While it’s a helpful starting point, it’s essential to consider other factors like property condition, location, and market trends.

Which property is best for investment?

The best property for investment largely depends on your investment goals. For some, single-family homes in suburban areas might offer steady rental income. Commercial properties or multi-family homes in urban settings promise higher returns for others. Always consider factors like location, market demand, and growth potential.

What is an investment property example?

An investment property refers to real estate property purchased to earn a return on the investment either through rental income, the future resale of the property, or both. Examples include single-family homes, apartment buildings, commercial properties, vacation rentals, and even plots of land.

What type of property is most profitable?

Profitability varies based on market trends, location, and the property’s condition. Generally, multi-family homes or commercial properties can offer higher rental yields. However, single-family homes might appreciate better in the long term. Additionally, vacation properties in tourist hotspots or rapidly developing areas can be profitable.

How much profit should you make on a rental property?

A standard benchmark is aiming for a 6% to 8% annual return on your investment initially, but this can grow over time as rent increases and the property appreciates. However, profitability can vary based on location, property type, and market conditions.

Why buy a house for an investment?

Purchasing an investment house can provide several financial benefits, including passive rental income, potential appreciation in property value over time, and tax benefits. Additionally, real estate is often seen as a tangible asset, offering a hedge against inflation.

What does the IRS consider a second home?

The IRS defines a second home as a property you don’t rent out; if you do, it’s for no more than 14 days a year.

In the context of taxes, interest on a mortgage for a second home is deductible, similar to the interest on the mortgage of a primary residence. However, different rules might apply if you rent it out for more extended periods. Always consult with a tax professional for specific guidance.

What do I need to buy an investment property?

You need to consider the following factors to buy an investment property:

- Financial Preparedness: Understand your credit score, save for a down payment, and get pre-approved for a mortgage.

- Market Research: Study property values, rental yields, and neighborhood growth trends.

- Type of Property: Decide between residential, commercial, or vacation rentals.

- Legal and Regulatory Knowledge: Familiarize with local zoning laws, rental regulations, and landlord-tenant rights.

- Professional Consultation: Consider hiring a real estate agent, legal advisor, and property manager.

- Property Inspection: Ensure the property is structurally sound and aligns with your investment goals.