When applying for a loan to purchase a home, you’ll be required to submit information about your income and any debts that you have. Mortgage lenders review this information, along with a variety of other information, like your credit score and tax documents, to determine how large of a mortgage you’ll be eligible for.

Your debt-to-income (DTI) ratio is one of the many factors lenders use to determine how well you’ll be able to repay a mortgage. Read on to learn more about DTI, how it affects your loan, and what you can do to improve your DTI.

Understanding Your Debt-to-Income Ratio (DTI)

Debt-to-income ratio, commonly called DTI, is a ratio of the money you earn each month compared to your monthly debt payments. Lenders look at your DTI as one factor in determining how well you may be able to repay a loan. If your finances are already tied up in monthly debt, you may not have enough left over to make monthly mortgage payments.

If you’re planning to purchase a new home or refinance your existing one, you must understand DTI and how to calculate your own. You’ll have a better idea of how much money you may be able to borrow before meeting with a real estate agent and a lender.

You can calculate your DTI by adding up all of the debt payments you make each month. These payments include personal loans, auto loans, credit card bills, student loan repayments, etc. Your debt doesn’t include monthly utilities you pay, like electricity and internet. Take the sum and divide it by your gross monthly income (your income before taxes). Multiply the answer by 100, and you’ll have your DTI.

Example

Let’s say you have three monthly debts – a car note of $560, a student loan repayment of $326, and credit card debt with a monthly minimum payment of $75. Those three amounts total $961.

Your gross monthly income is $3,500. When you divide $961 by $3,500, you get 0.27 or 27%. Your DTI is 27%. Essentially, 27% of your monthly income goes to repaying debts.

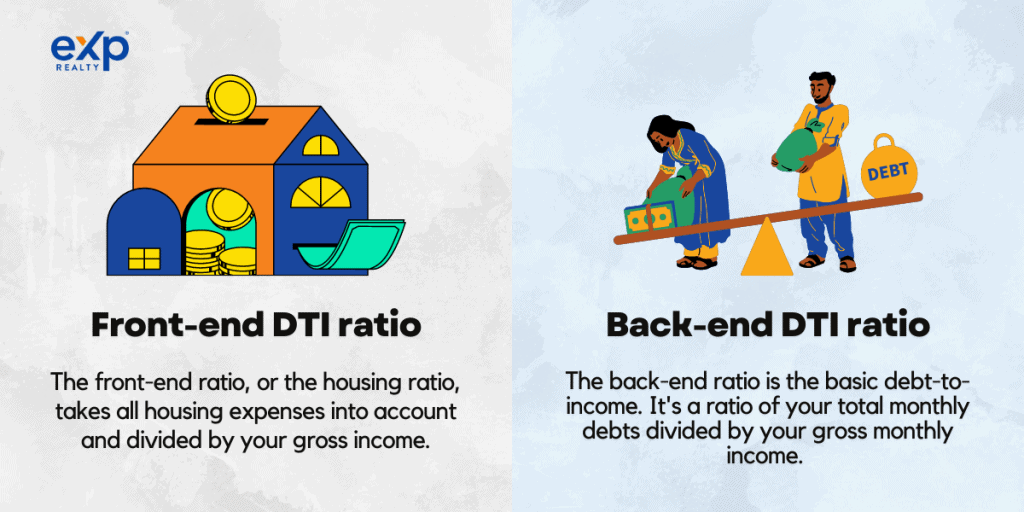

Types of DTI: Front-End and Back-End

Lenders factor in two types of DTI when evaluating a loan application: front-end DTI and back-end DTI. The front-end ratio, also called the housing ratio, takes all housing expenses into account, like mortgage payments, homeowners insurance, property taxes, and homeowners association fees. This total is divided by your gross income.

Most banks consider anything under 28% to be an ideal front-end ratio. However, many banks will accept a higher percentage if other factors are favorable.

The back-end ratio is the basic debt-to-income. It’s a ratio of your total monthly debts divided by your gross monthly income.

Why DTI Matters and How It Affects Your Loan

Lenders see DTI as a solid indicator of how well you will be able to repay a loan. A high DTI indicates that you may struggle to take on another payment. If you have a lot of debt, particularly credit card debt, lenders may also see you as a risk.

Alternatively, a low DTI indicates that you have enough money to make a mortgage payment. You’ll be more likely to get a lower interest rate. It’s also proof that you make responsible choices with your credit. Your DTI not only determines whether you’re eligible for a loan, but it also helps lenders decide how much to approve you for.

It’s a good idea to meet with a mortgage lender before you set up a meeting with a realtor or begin to look at houses. Once you have an approval letter, you’ll be able to manage your expectations about the type of house you can afford. You can also give your realtor an idea of the best houses to show you.

What Should Your DTI Be?

Different lenders and different types of loans have different debt-to-income requirements. Most lenders prefer a DTI below 35-36%. However, some lenders allow up to 43%.

There are a few loans that allow up to 50% for a DTI, but borrowers usually have extenuating factors. For example, you may be able to get a loan if you have savings that will cover six months or more of your expenses.

Your DTI ratio affects both your chances of approval and how much money you’ll be able to borrow. A lower DTI means that you’ll be more likely to get the loan you need.

Factors Affecting Your DTI

There are several factors that affect your DTI. Understanding each of these factors will help you understand how your income and any debt you have may affect your DTI and, subsequently, your ability to get a loan.

Rent/Mortgage Payments

If you currently pay rent or mortgage notes each month, lenders will often consider that when calculating your DTI, particularly if you’re applying to refinance. It also gives lenders an idea of how large of a mortgage note you can comfortably manage.

Car Payments and Other Personal Loans

If you financed your vehicle, the monthly note you pay would factor into your DTI.

Student Loans

Lenders calculate your student loans based on the type of loan you’re applying for. In many cases, the lender looks at what you’re required to pay each month. They may also take 0.5-5% of your loan balance and divide it by 12 months. That number will be added to your monthly debt.

If your debt has been forgiven, it won’t factor into your DTI. If you’re applying for a VA loan and your payments are deferred at least 12 months past the mortgage closing date, your loan also won’t be added in.

Credit Card Debt

If you have credit card debt, it will factor into your DTI. Only the minimum monthly payment is added in, even if you pay more than that each month.

Child Support/Alimony Payments

Any child support or alimony payments that you make each month are counted in your debt-to-income ratio, even though these payments aren’t technically “debt.”

Expenses Not Factored Into DTI

Other monthly bills, such as utilities like electricity, water, and internet, don’t factor into your DTI. You also don’t need to calculate living expenses like groceries.

Gross Monthly Income

Your gross monthly income is the amount of money you earn before taxes are withheld. If you have multiple sources of income, you’ll add them together to get your household income.

Tips for Improving Your DTI

Even if your DTI isn’t low enough to get the loan you want, that doesn’t mean there’s nothing you can do. There are several ways you can improve your DTI and increase your chances of getting a loan, especially if you are a first-time homebuyer.

Pay Off Small Debts

When looking at your outstanding debt, decide if there are any debts you can pay off. You may have credit card debt or small personal loans that you can pay off in a few months or less. Start with these and then use that money to apply to larger debts. Paying off debts also helps with your credit score.

If you pay off a credit card, it’s important not to close out the card during the mortgage application process. While it may seem like one less credit card could only help your DTI ratio and your credit utilization ratio, it can actually hurt you. The credit utilization ratio is a calculation of your actual credit debt divided by your credit limit. When you close a card, your credit limit goes down, increasing the percentage.

Consolidate, Refinance, and Negotiate Debt

Even if you can’t pay off your debt, you may be able to change the way you pay it off and lower your monthly note. You may be able to consolidate debt, or roll your debt into one loan. Debt consolidation can often lower your monthly payment and may lower your interest rate.

Be sure to check out the interest rates on your debt. You may be able to get a lower interest rate if you’re in a better financial situation or have a higher credit score. By refinancing these loans, you can get a lower monthly payment.

In some cases, you may be able to negotiate with creditors to decrease your overall debt. Your monthly payment will also decrease.

Increase Income

You can also try to increase your income. You may ask for a raise at your current job or find a new job with higher pay. You may also take on a side-hustle or extra job to earn more money.

Create a Budget

While trying to lower your DTI, you need a plan to get out of debt and a budget to help you avoid taking on more debt. Try to see where you can limit your expenses and dedicate that money to paying down your debt.

Get Advice

If you need more help with lowering your DTI, you can talk to a financial advisor or take a homebuyer education course. These advisors can give you expert advice tailored to your situation.

Key Takeaways

When preparing to purchase a new home, it’s important to understand your debt-to-income ratio. Your DTI, along with your credit score and credit utilization, is one of the biggest factors lenders use to set the terms of your loan and even decide if you’re eligible for a loan.

Your DTI isn’t permanent. You can decrease it by increasing your income, paying down debt, and creating a budget.

Once you understand your DTI, you’ll have a clearer picture of your financial situation. As you take steps to lower your DTI, you’ll be closer to securing the loan you want.

FAQs

Do you have more questions about debt-to-income ratios? We have answers!

What is the highest debt-to-income ratio for a mortgage?

Most lenders prefer a DTI under 35-36%. Certain lenders will allow a DTI of up to 43%, and a select few loans allow a DTI of up to 50%. Remember, even if you’re approved for a loan, a higher DTI will affect your terms.

What is a realistic debt-to-income ratio?

You’ll often be able to get a loan with a DTI of less than 43%. However, you may have a higher interest rate and fees. Any DTI under 35% is ideal.

What is the max DTI for FHA?

If you’re interested in getting an FHA loan, the max DTI is 43% or lower.

What is the DTI for conventional loans for 2022?

Most conventional loans require a max debt-to-income ratio of 36-43%. Anything below these percentages makes it more likely that you’ll get approved and have better terms.

What debt-to-income ratio do banks look for?

Banks typically look for a DTI below 36-43%. However, some banks will allow a DTI of up to 50% with other qualifications.

How can I lower my debt-to-income ratio?

There are several ways you can lower your DTI. You can decrease your monthly debt obligation by paying off loans. You may be able to consolidate or refinance some of your loans to lower your monthly payments.

Finally, you can also try to earn more money. You can add an additional income stream through a part-time job or taking on a higher-paying job.

How does credit card debt affect DTI?

Credit card debt doesn’t affect your DTI as much as it affects your credit score and credit utilization ratio. A DTI calculation only factors in your minimum payment for each credit card.

Still, the credit card minimum payment is based on how much you’ve charged. Higher credit card debt means a higher monthly payment.

Is 50% a good debt-to-income ratio?

A 50% DTI is at the highest end for a home loan. While a select few lenders may approve you for a loan, the terms won’t be ideal.

Can I get a loan with a high debt-to-income ratio?

You can potentially get a mortgage loan with a high debt-to-income ratio, even up to 50% in some cases. However, a high DTI indicates that you may be struggling with your monthly expenses.

A loan that allows for a high DTI often comes with strict terms that make your monthly payments more expensive. If you’re already struggling, taking on a high mortgage payment may affect your financial health.

Ready to Buy a Home?

When you’re ready to buy a home, eXp Realty can help. You can use our site to search local properties and sign up to receive notifications when new properties come on the market. Get in touch with one of our experienced agents today.