Are you considering investing in real estate? It’s an exciting opportunity, but it’s essential to tread carefully. Before taking the plunge, you must understand the return on investment (ROI) concept and how it applies to real estate.

Read on to understand the nuances of ROI in real estate and explore critical considerations to remember before making any investment decisions. Whether you’re a seasoned investor or a beginner, this article will provide valuable insights to make informed choices and maximize your returns in the dynamic world of real estate.

What Is ROI in Real Estate?

When it comes to real estate investing, ROI is a crucial concept to understand. It’s a financial metric that helps investors gauge the profitability of an investment compared to its initial cost. ROI is a way to assess how much money you can make from a property investment.

Real estate investors use ROI to assess the financial viability of a property investment. It considers the potential gains and the costs associated with the investment. These include purchase prices, property taxes, maintenance fees, and financing expenses.

Investors can determine if a property generates positive returns by comparing ROI for different investment opportunities. That way, they can make informed decisions about buying, holding, or selling a property.

Factors that Affect ROI in Real Estate

As a real estate investor, it’s crucial to understand that ROI depends not solely on the property but also on various external factors. These factors can significantly impact the profitability of your real estate investment and should be carefully considered when evaluating potential opportunities.

Location

When it comes to real estate investing, location is everything. A property in a desirable area can generate high rental income and appreciate in value over time.

So, what makes a location desirable? The answer varies depending on the type of property you’re investing in. Generally, a desirable location is characterized by factors such as proximity to schools, public transportation, shopping and entertainment, and job opportunities.

Investing in a property located in a less desirable area may offer a lower purchase price, but it may also result in lower rental income and appreciation potential.

Property Type

Different types of properties have varying levels of profitability and maintenance requirements. Let’s start with commercial properties. Commercial properties, such as office buildings, retail spaces, and industrial properties, are typically leased to businesses for commercial purposes.

These properties often generate higher rental income than residential properties due to longer lease terms and higher rental rates. However, they also come with higher upfront costs and extended vacancy periods. Commercial properties may also be subject to market trends and economic conditions, affecting their ROI.

On the other hand, residential properties may offer lower rental income than commercial properties, but they often come with lower upfront costs and more straightforward management requirements. They are also influenced by population growth, employment trends, and housing demand, which can impact the average ROI.

Condition of Property

When considering the condition of a property, it’s vital to assess its current state and any potential repair or renovation needs. Properties in good condition with updated features and well-maintained infrastructure are more likely to attract quality tenants and generate higher rental income. Such properties may also have a higher potential for appreciation in value over time, which can result in higher returns when sold.

On the other hand, properties in poor condition or in need of significant repairs may have lower rental income and may require more frequent and costly maintenance. This can eat into your ROI and affect the overall profitability of the initial investment. It’s important to carefully assess the condition of a property and factor in potential repair and maintenance costs when evaluating the ROI of a real estate investment.

Market Condition

Market conditions encompass supply and demand dynamics, rental rates, and the potential for property appreciation. In a robust real estate market with high demand, properties are more likely to have higher rental rates and may experience appreciation in value over time. This can result in higher rental income and a higher potential for appreciation, leading to a likely higher ROI.

On the other hand, in a soft or declining real estate market with low demand, rental rates may be lower, and the potential for property appreciation may be limited, which can impact the overall ROI of an investment.

Neighborhood

When evaluating a real estate investment, it’s crucial to assess the neighborhood where the property is located carefully. Researching and understanding local neighborhood dynamics, such as crime rates, can provide insights into the potential for appreciation, rental income, and tenant demand.

Amenities

Amenities refer to the features, facilities, and services offered by a property or its surrounding neighborhood that can enhance the quality of life for tenants.

Properties with attractive amenities can command higher rental rates and attract a larger pool of potential tenants. Amenities such as a fitness center, swimming pool, on-site laundry facilities, parking, outdoor spaces, and security features can add value to a property and make it more appealing.

How To Calculate ROI in Real Estate

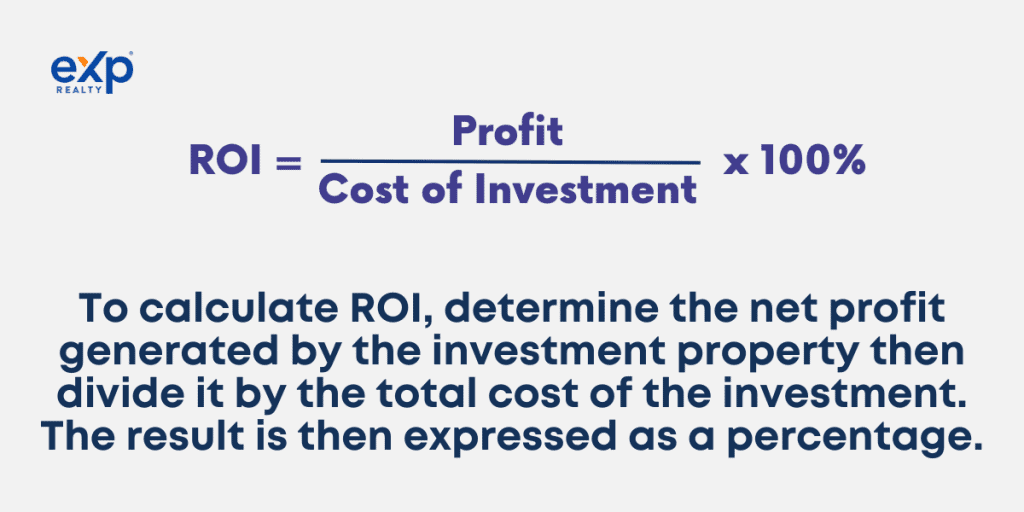

Calculating ROI in real estate is an essential step in evaluating the financial viability of a potential investment. To calculate ROI, you first need to determine the net profit generated by the investment property. This is the income earned from the property minus any associated expenses, such as property taxes, maintenance fees, and financing costs.

Once you have calculated the net profit, you need to divide it by the total cost of the investment. The total cost includes not only the purchase price of the property but also any costs associated with acquiring and holding the property, such as closing costs, renovation expenses, and ongoing maintenance costs.

The result of this ROI calculation is then expressed as a percentage. A higher percentage indicates a higher ROI and a more profitable investment.

Tips for Maximizing ROI in Real Estate Investment

If you’re considering investing in real estate, you’re likely looking to maximize your returns and make the most of your investment. However, achieving a high ROI in real estate requires careful planning, strategic decision-making, and a deep understanding of the market. Here are some tips for maximizing ROI while investing in real estate:

- Researching the market thoroughly and investing in a property that aligns with your goals is a crucial first step. Understanding the market trends, demand, and potential for growth can help you make informed decisions and choose a property that has the potential to yield higher returns in the long run.

- Assessing your investment’s potential risks and returns before purchasing is essential. Conduct a thorough analysis of the property’s financials, including cash flow projections, operating expenses, and potential appreciation, to determine if the investment aligns with your financial goals and risk tolerance. This will enable you to make informed decisions and minimize risks.

- Hiring a professional property manager can significantly impact your ROI. An experienced property manager can efficiently handle day-to-day operations, tenant screening, rent collection, property maintenance, and other tasks, leading to higher occupancy rates and optimal rental income.

- Regular maintenance and upgrades to the property is essential to maintaining its value. A well-maintained property is more likely to attract and retain tenants, leading to consistent rental income and increased property value over time. Additionally, making strategic upgrades and improvements to the property can increase its appeal to potential tenants and allow you to command a higher rent.

- Managing expenses and minimizing costs wherever possible is crucial to maximizing ROI. Keep a close eye on your expenses, including property taxes, insurance, maintenance costs, and utility bills. Look for cost-saving opportunities, such as negotiating favorable contracts with vendors and suppliers, and consider investing in energy-efficient upgrades to minimize operating expenses.

- Adding value to the property is another effective strategy to maximize ROI. Consider making improvements or adding amenities that can increase the property’s value, such as upgrading the kitchen, adding a gym or a community room, or improving the landscaping.

- Periodically reviewing and adjusting your rental rates based on local rental rates and market demand can help you optimize your rental income and ROI.

- Effective marketing of your property is essential to attract and retain tenants. Develop a comprehensive marketing plan that includes online and offline strategies to showcase the property’s unique features and attract quality tenants.

- Maintaining good tenant relationships and providing excellent customer service can also result in longer lease terms and reduced vacancy rates, contributing to higher ROI.

- Consider diversifying your investments by investing in different types of properties or locations. Diversification can help you spread your risk and maximize ROI by exploiting market opportunities. Investing in properties with different income streams, such as residential, commercial, or mixed-use properties, can provide stability and diversification to your portfolio.

Risks and Challenges of Investing in Real Estate

Now you have to be aware of the potential risks and challenges that may come your way. One significant challenge to keep in mind is the lack of liquidity. Unlike other investment options, real estate investments are typically long-term commitments, and it may take time to sell a property or access your invested capital.

Another challenge to be prepared for is fluctuating market conditions. The real estate market can be subject to ups and downs due to various economic factors, supply and demand dynamics, and local market conditions. It’s important to understand that the market can change over time, and you may need to adjust your investment strategy accordingly.

Managing Tenants and Obtaining Financing

Managing tenants can be another challenge in real estate investing. Dealing with rent collection, property upkeep, and potential eviction proceedings can be time-consuming and stressful. Be prepared for repair costs. Properties require ongoing maintenance and repairs, which can add up over time.

Obtaining financing for real estate investments can also pose challenges, especially for first-time investors or in times of tight lending standards. Knowing the potential challenges of obtaining financing is essential, such as higher interest rates, down payment requirements, and credit score criteria.

Key Takeaways

Maximizing ROI in real estate investment requires careful research, analysis, and informed decision-making. Take the time to thoroughly research and analyze different investment opportunities before purchasing.

Additionally, seek the advice of real estate agents, financial advisors, and legal experts to gain valuable insights and guidance. They can help you navigate the complex world of real estate investment and provide expert advice tailored to your specific circumstances.

Remember, making an informed decision based on your personal financial situation and investment goals is crucial. Carefully evaluate different investment opportunities and ensure they align with your long-term objectives. With careful research, analysis, and professional guidance, you can maximize your ROI in real estate and achieve your investment goals.

FAQs: ROI Real Estate

Have you got questions about real estate investing? Check out our frequently asked questions (FAQ) section about ROI Real Estate below.

What does ROI mean in real estate?

ROI stands for “return on investment” in real estate, a financial metric used to evaluate the profitability of a property investment relative to its initial cost.

What is the 2% rule in real estate?

The 2% rule in real estate refers to a guideline where the monthly rental income from a property should be at least 2% of the property’s purchase price. Some investors use it as a quick way to assess the potential cash flow of a rental property.

How do you calculate ROI in real estate?

To calculate ROI in real estate, you divide the net profit of an investment property (which includes rental income and property appreciation) by the total cost of the investment (including purchase price, taxes, maintenance fees, financing expenses, etc.), and then express the result as a percentage.

Where is ROI the highest for real estate?

The ROI in real estate can vary depending on various factors such as location, market conditions, property type, and amenities. Generally, properties in emerging markets or areas with high demand and appreciation potential tend to have higher ROI.

What is a good ROI percentage?

A good ROI percentage in real estate typically varies depending on individual investment goals and risk tolerance. Generally, a double-digit ROI percentage (e.g., 10% or higher) is considered favorable in real estate investing. However, it’s essential to consider other factors such as market conditions, property type, and financing options.

How do I maximize ROI on a rental property?

To maximize ROI on a rental property, consider factors such as property location, property type, condition, amenities, and market demand. Conduct thorough research, analyze different investment opportunities, optimize rental income through competitive rent rates, and minimize expenses through efficient property management and maintenance practices. Seeking professional advice can also help maximize ROI on a rental property.