Buying a house is an exciting and life-changing event. The home-buying process, though, can be confusing, and buying a house can be frustrating if it takes longer than expected.

Fortunately, you can do a few things to speed up the process. Mainly those steps include doing a lot of preparation work, having all your ends squared away before you begin, and working with a competent real estate and mortgage broker.

The following is a summary of the various processes that go into buying a home and what you can do to speed that process up.

Understanding the Home Buying Process

No matter what you do, understanding how something works always gives you an advantage. Understanding the process entailed in buying a home is also much easier to navigate if you know what you are doing. Not only can you make informed decisions, but you avoid all the pitfalls in the process.

At least, you should understand how:

- Mortgage Pre-approval of loans work

- Mortgage companies assess your risk as a borrower

- To put together data for a mortgage loan approval process

- Your credit history affects your credit score and what is available to you

- The local housing market and competitive market analysis affect the asking price

If those are the only aspects of buying a home you understand, you have a leg up on the average homebuyer.

The only way you learn those things is to do your research and ask questions of housing professionals like:

- Mortgage company personnel

- An experienced agent in your real estate market

- Title Attorneys

- Home inspectors

If you cannot access all of those real estate experts, you must do your research.

Step 1: Know How Much You Can Afford

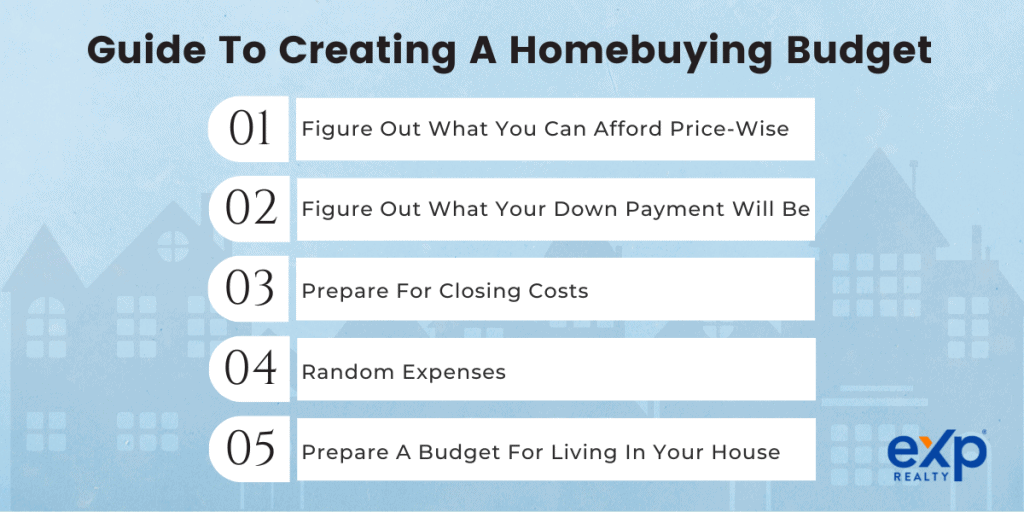

Your natural first step is figuring out your financial situation and how much you can afford to spend on a house. Suppose you have no idea, or just a vague idea of how much you need to spend. In that case, you will end up wasting time looking at properties you cannot afford or possibly buying something that is below what you can afford to spend.

To start figuring out your housing budget, examine your financial history and write down all your monthly expenses, including what you spend in an average month on everyday living. Then, establish a minimum amount to cover your monthly expenses and compare that to how much you earn each month.

If you are part of a couple, combine your monthly expenses and resources and develop your annual income and expenses.

If you have a surplus of revenue after you deduct expenses, your down payment, moving costs (including closing costs,) and mortgage commitment will come out of that money. Once you have purchased your home, your mortgage costs will be a monthly expense until you pay the home off or sell it.

By breaking down your expenses this way, you can figure out what you can comfortably afford regarding home sale prices. What you can afford can affect everything from mortgage pre-approval processes and your monthly payment to your down payment and whether you can afford an all-cash offer (which can be a great leverage point in negotiations.)

Additionally, you can set your monthly budget minimum, which gives you something to aim for each month regarding how much expendable income you possess. Identifying what you can safely afford also lets you figure out if you can look at pricier homes without putting yourself under a financial strain.

Regarding time, looking at bank statements, bills, and other financial documents should only take a couple of days.

Step 2: Find a Real Estate Agent

Once your budget is set, the next step is finding a real estate agent to represent you. For first-time home buyers, a qualified and competent agent is invaluable. Even for seasoned home buyers, a good broker is well worth any agent commissions they might collect from both a buyer’s or seller’s perspective.

At the very least, a skilled real estate broker can tell you if the purchase price for a home is realistic or if you are overpaying or getting a deal. Additionally, most agents are familiar with all the players in the closing process. They can help you navigate local government and the loan process, address an inspection report or closing disclosure, and provide you with an assessment of the neighborhood you are moving to.

To find a qualified agent:

- Research your market of interest and look for referrals.

- Check out business ratings and ask folks you meet in the area for recommendations.

- Interview multiple real estate brokers to understand their style.

- Detail your needs and let them get back to you with a plan for achieving those goals.

- Choose the agent that you feel the most comfortable with.

Step 3: Start House Hunting

The house hunting process is probably the most challenging part of the house buying experience, but fun part of the entire home buying process. Every other part of the entire process follows a sequence of procedures.

Looking at the available homes for sale is your chance to do a comparative market analysis, figure out what you want in a dream home, visit open houses, and see what is on the market.

You can also define the “must-haves” for you and your family and compare them with the “nice-to-haves” to ensure the home you choose meets your needs. While researching options online and determining what you want and can afford is time-consuming, most people enjoy this phase of the house-buying process the most.

Basic House Hunting Tips for Homebuyers

When house hunting, it is important that you stay organized so that you can keep track of the properties you like versus the properties that merely interest you. You also can figure out what you do not like or what aspects of a home or neighborhood are non-negotiable. The results might surprise you.

For example, you might think that starting, you have to live a certain distance from where you work. Once you explore the market, however, you might find out aspects of the available homes that change your mind. Those could include:

- A quicker commute means you can live further away

- Paying a little more gets you a better deal in terms of quality of life

- Staying in one area over another reduces homeowner’s insurance

- Going with an older home gets you more room

- A neighborhood you thought you did not like is charming

These are just a few things you can learn when house hunting.

Step 4: Get Pre-Approved for a Mortgage

While house hunting can be the most enjoyable part of buying a home (next to moving in and getting settled,) getting mortgage pre – approval is probably the most important aspect. Unless you are wealthy and can pay in cash, a loan pre-approval gives you peace of mind and lets you plan for the type of neighborhood you want to live in and the house you want to buy.

The preapproval process can be time-consuming. To make it go as smoothly as possible, you need to get your financial documents and other paperwork before you talk to any lender. Some of the documents you will need include the following:

- Current credit report and credit profile

- Income statements

- Tax returns (Local, state, and federal tax returns)

- Debt to income ratio and debt totals

You will also need to figure out if you want a conventional loan or want to investigate a hybrid arrangement, like an all-cash purchase or owner-financed mortgage. Identifying the right type of loan or financial arrangement is critical because of the cash outlay and the fact that you will live with that mortgage for years.

The more thoroughly you research lenders, consider your options and financial situation, and get and review quotes to identify the best offer, the better off you will be. Mortgage applications are incredibly detailed, so you must provide your lender with everything they ask. Not including information can delay and even sink the mortgage process before it gets started.

The rest of the process is researching lenders, getting quotes, and selecting the right mortgage arrangement for your needs.

Step 5: Make an Offer and Negotiate

While most people enjoy the house-hunting part of the process, a few get into negotiating a purchase price. If you are not a natural negotiator, you can rely on your agent to present your case to the seller or the seller’s agent.

The goal of negotiating is to make sure you get a fair price on your dream home, so you want to have the best negotiator possible in your corner.

Step 6: Complete the Home Inspection

Home inspection is the process that you control by hiring the right individual. Research available inspection companies and private inspectors and hire the most reputable one. Attend the inspection and ask any questions you have. Bring up any concerns that arise from the inspection and listen to what your inspector recommends.

After the inspection, what you do is up to you. If there are needed repairs, you can delay the sale until they are addressed by the seller. Or, you can use the needed repairs as leverage to get a better purchase price. Generally, if you have a price locked in, letting the seller handle the repairs is quicker, but they will also usually to the minimum to meet the inspection requirements.

For major repairs, you might want to try and negotiate a better price and let the seller address the issues as a fallback if they do not want to budge on the price. With any repairs, balance the need to get the work done with your need to close the deal and move into your new home.

It might be worth it, even if you will not see a tremendous price reduction, to do the repairs yourself to keep the process moving.

Step 7: Close on the House

The closing process is the final step and is as important as any other part. You need to make sure you have all the required documents on hand. You will also need to arrange to make any tax payments, work out details regarding moving into your new home, and then, finally, move in.

Your real estate agent can handle most of these details and walk you through the process.

After the taxes are paid, money has been exchanged, agents paid, and paperwork filed, you get to celebrate. But do not celebrate for too long. You still have to move.

Key Takeaways

Search for the best properties today, but don’t forget that buying a home involves several steps. First, figure out your finances and set a budget. Next, identify and hire a qualified real estate agent and perform market research on the area you want to live in. Visit available homes in that area with your agent.

Once you find a home you like, start the mortgage process and make sure you have all the necessary documents. Next, negotiate the price and oversee the home inspection process. If there is work to be done, use it as leverage. Finally, close on the home and move in.

While it may seem simple on paper, buying a home can be an arduous process with many moving parts. To help with the process, it’s important to contact a qualified real estate broker as soon as possible. Remember that every house purchase has momentum, and much of the process depends on your motivation and organization. If you’re not organized and don’t do your homework, you may end up with a home that is less than you deserve.

FAQs: How Long Does it Take To Buy a House

The following are the most common questions from prospective homebuyers.

How long does it realistically take to buy a house?

The average time to buy a house is four to five months. It can take as little as 30 days in special circumstances, but you must have all the details worked out to avoid delays. If you have any issues with the bank, the home you are buying, negotiating a sale, getting inspection issues addressed, or with the closing, the process can take longer.

While you are anxious to get into your new home, remember that buying a home is one of the major decisions you will make in life. You do not want to hurt your position, settle for less than you can get, or end up with buyer’s remorse, just because you were impatient.

If you are on a time timeline, one option is to consider renting for a while until you can find the home of your dreams. It means putting off your desires but can pay off in the long run. Remember, “making perfect the enemy of the good” rarely pays off when buying a home.

Why does it take 30 days to buy a house?

The process takes some time to work through. When you consider all the moving parts – finding a home, working with the bank, negotiating a sale, inspection, and closing processes, 30 days is a short time for a lot to happen. To complete the process that quickly, your best bet is to work with the best real estate brokerage on the market.

What takes the longest in buying a house?

That is impossible to know. Your ability to secure a loan, sometimes homeowners have a schedule they want to follow regarding moving out, and issues found during home inspections and getting them addressed are just three variables that can add considerable time to the selling process.

What is the fastest you can close a mortgage?

The speed at which you can close a mortgage depends on several factors, including your financial situation and preparedness when applying. Being thorough and organized can help speed up the process. This means having all necessary financial documents and information ready to provide to the lender, such as proof of income, tax returns, and credit reports.

It’s also important to research and compare different mortgage options to find the best fit for your needs. Sometimes, closing a mortgage in as little as 30 days may be possible. Still, the timeline can vary depending on individual circumstances.

How can I speed up closing on a house?

The best thing you can do is have your financing, credit, and loan paperwork in good order and ready to submit so there are no hang ups with the mortgage lender. After that, making a cash offer can speed up the process, as can completing all the paperwork as soon as possible.

Another way to speed up the home-buying process is to work closely with qualified real estate personnel that know the local real estate market where you are looking to buy.

Is buying a house a fast process?

That depends on the preparation you put into the process. If you have a home in mind before you start, for example, a lot of time searching for the right home is avoided. If you have your financial “ducks in a row,” you can speed up a real estate purchase. Some of the processes, however, will move along at their own pace, and there is not a lot you can do to speed it up.