In TV shows, buying a dream house seems so simple; the character views a home, says, “I’ll take it!” and by the next scene, they’re moving in. Finding homes for sale and buying your own takes more time and effort in real life. Not to mention the additional costs.

Preparing to buy a house is usually a months-long process that involves research, cooperation, and determination. No need to worry; you won’t have to go it alone.

You’ll have the experienced professionals from eXprealty.com in your corner helping you do the heavy lifting, search for properties, and get alerts of new properties when they come on the market.

Read on to learn more about the steps involved in preparing to buy a house and the home-buying process itself.

Get Your Finances in Order

When you’re setting out to purchase a home, you already know it will affect your financial life, but many people don’t realize how much their financial decisions will matter.

Owning a house has many benefits, but like any other major purchase decision, it carries costs and demands you may not have anticipated.

When beginning your journey to homeownership, one of your first missions is to get all your finances in order and understand your monthly expenses and ability to budget for your goal. You’ll also have to figure out your other expenses, like paying back student loans.

During the purchase process, you will be asked to produce information and proof about your finances and have your income, debts, and assets measured and scrutinized as they’ve never been before. That’s why it’s so important to have things in order before you begin.

This can seem like a daunting prospect, but the sooner you begin to analyze, repair, and organize your finances, the sooner you can move toward your goal. Hang in there and have patience.

When the process is done, you’ll likely find yourself better informed and more empowered than before.

Debt-to-Income Ratio (DTI)

When a lender is considering granting you a loan, one of the primary things they’ll look at is the debt-to-income ratio or DTI.

A borrower with the lion’s share of their income going to existing monthly debts would quickly be overwhelmed by the additional load of a mortgage, so lenders are careful when calculating this number.

Your debt-to-income ratio shows how much money you make versus how much you owe monthly. It is calculated by adding up all the debts you pay each month and dividing that number by your monthly income.

When doing these calculations, lenders use your gross monthly income, which means the number you make before taxes are taken out.

For example, let’s say your monthly income is $5,000. You have a car payment of $400 each month and credit card payments amounting to another $400. If your mortgage payment is 1,100, you have a total debt of $1,900.

This gives you a debt-to-income ratio of 38%. There are better DTIs, but it is still within the parameters many lenders will accept. Typically, the highest DTI you can have and still be approved for a mortgage loan is 43%.

It’s common for the average American to have a much higher DTI than this. That’s why many people preparing to buy a house need to take time to address their debt for at least a year before home shopping.

Tips for Lowering Your DTI

There are only two ways to decrease your DTI: lowering your monthly debts or raising your monthly income.

The first step to lowering your debt-to-income ratio is simple: don’t take on any new debt! That new credit card, vehicle loan, or other obligation will hike up your DTI, making it all the more difficult for you to dig yourself out.

The next step is to pay off your existing debts. This often involves negotiating with debtors to let you pay off your debt for a lesser amount or asking them to lower your interest rates.

This aspect of financial overhaul can be stressful, but remember that sometimes, reducing or eliminating even one debt can lower your DTI enough to help you secure a mortgage or use private mortgage insurance.

As you’re preparing to buy a house, you can also take steps to increase your income. Whether you switch jobs, ask for a raise, or take on a side gig, every little bit you can make will count toward a lower DTI.

Liquid Assets

Your liquid assets are a significant part of your financial profile and should be considered when you’re preparing to buy a house.

Liquid assets include cash and things you can turn into cash immediately. They include:

- Cash on hand

- Checking or savings accounts

- Stocks and bonds

- Mutual funds

Liquid assets are different from non-liquid assets. Non-liquid assets are things like homes, property, and other assets you cannot access immediately.

For example, an owned property is not guaranteed to sell, and if it does, it may take months to have the cash from the deal in your hand.

Non-liquid assets are also things that can depreciate over time, while liquid assets have a stable value.

So, why do liquid and non-liquid assets matter when preparing to buy a house? It’s because these things are counted toward your overall assets when evaluating your finances for a mortgage loan.

Lenders want to know you’ll have enough money in your bank account to cover closing costs and other costs of buying a home, so if you have accessible funds, it looks good for you.

Credit Scores

Credit scores are among the top items on the list of concerns when buying a home. Before a lender gives you a loan, they’ll want to be confident that you are good about paying your bills and paying them on time.

Most people know that having a very low credit score can make getting a mortgage impossible, but there are other ways your credit history can affect your loan.

Having a non-ideal credit score often means that the loan you qualify for will have high-interest rates. High-interest rates mean extra money tacked on to your monthly mortgage payment. Using mortgage calculators can help you understand how it will affect your monthly rates.

If you want to get the best deal you can on your mortgage, you must clean up your credit. The first step is to do no further harm to your credit report and avoid a credit check. Once you decide you’re serious about being a homeowner, don’t open up new lines of credit.

Fixing Your Credit

First, closely examine your credit reports from all three major credit agencies. If you see any debts you did not make, or other irregularities, you can dispute them with these agencies.

You’d be surprised how many people have incorrect information on their credit reports and don’t even realize it.

Your report will also help you gather information on who you owe. In many instances, overdue debts get sold to collection agencies and are no longer in the hands of the original debtor.

Finding out who holds the debt is essential. This way, you can contact your creditors to make arrangements to pay down your debts. Creditors sometimes will accept Offers in Compromise.

This means they will accept a payoff amount that’s lower than what you owe. Usually, to be eligible for this offer, you must sign a document promising to pay off the debt within a short time frame, whether in one lump sum or several installments.

In some cases, a licensed credit counselor can help you with the debt-reduction process. Whatever way you do it, it will still take time (usually a few months at least) and some legwork to get your debts down and your score up.

Saving for a Down Payment

A down payment is the money you pay upfront when you want to buy a house. The amount varies greatly and depends mainly on the purchase price of the house and the type of mortgage you have.

Unless you already have healthy savings set aside, you’ll need to start saving up for your downpayment well in advance. Reaching your savings goal is a key milestone in preparing to buy a house.

You will need to know how much you can spend on a downpayment and shoot for that savings goal.

It may seem like a near-impossible task from the beginning, especially if you’re starting from scratch. But don’t be overwhelmed; start saving little by little and you might be surprised by how much progress you’ve made over time.

Like anything else worth having, a home takes sacrifice. That means you may have to cut costs to set more money aside.

Extras like takeout food, salon visits, vacations, and hobbies may need to be set aside for a while. Some people temporarily stop setting aside their retirement fund money to save more quickly. You can also get a side gig to make extra money that will go straight into your savings.

If you fall into a lower income bracket, you may qualify for help with your down payment, closing costs, or both.

These loans can be from private organizations or government entities. Ask your mortgage professional about this type of help. Not all lenders accept this type of funding, so you’ll need to determine this before moving forward.

“Season” Your Money

It is best to overestimate your costs. That way, you aren’t underprepared. Your down payment isn’t the only thing you have to save for; you’ll also need to consider closing costs. We’ll go into further detail about those later in this article.

All money used for down payments and closing costs needs to be sourced, meaning the loaning bank will need to see where the money came from. If someone is gifting you all or part of your funds for the home, their account will also be scrutinized.

They usually go back a few months in your account to do this, so it’s best to have your home-related monies in place at least three months beforehand. This is called “seasoning” your funds and will be of great help during the closing process.

Determine Your Home-Buying Budget

How much house can you afford? This is one of the significant things you need to determine when preparing to buy a house.

Finding a Mortgage Professional

While online calculators can give you a clue about your home-buying power, the best way to determine your budget is by working with a mortgage loan professional.

Whether you choose a mortgage loan originator or a mortgage broker is up to you. Both do the same job, and their pay is rolled into your loan’s closing costs.

Your mortgage professional will guide you through the loan application process, instruct you on what documentation you need, help you understand contracts and other paperwork associated with the mortgage, and more.

Sometimes, they are affiliated with the real estate agency you’ll be using to find your house, so they can stay in close communication with your realtor throughout the home-buying journey.

Pre-Qualification vs. Pre-Approval

Your originator or broker can help you get prequalified and then pre-approved for a home loan. What’s the difference?

Pre-qualification is the first official stage of applying for a mortgage. Your mortgage originator or broker will run some preliminary numbers based on the information you give them, evaluating your income, credit score, and more, giving you a general picture of how much you can spend on a house.

For pre-approval, your mortgage professional will go through a similar process, but this time will do a deep dive into your information, using documented proof of your financial situation.

The resulting approval is a more serious indicator -although not a guarantee – that a mortgage lender will be willing to grant you a loan.

A pre-approval is what most real estate agents look for when they agree to work with you. Most agents today will only accept a client with a printed or digital pre-approval from a reputable source.

What Will Your Monthly Payments Be?

In the early stages of your home-buying journey, you won’t yet have an idea of how much you’ll pay in monthly mortgage payments, even if you know how much your house will likely be.

That’s because many different costs go into your mortgage payment, and you will know exactly how much those will add up to once you’re ready to close on your home.

Things that can affect your monthly payment and mortgage rate include:

- Your credit score. As mentioned previously, having a low credit score often leads to a higher interest rate on your mortgage.

- Types of mortgages. Different types of loans often have different payment structures and amounts.

- Downpayment. When you put a down payment on a home, that amount helps you lower your overall monthly payments because you’ve already paid part of the home’s purchase price. A downpayment can also help you avoid having to pay private mortgage insurance.

- Mortgage term. It’s simple math; $200,000 stretched out over 30 years will result in lower monthly installments than the amount stretched out over 10 years. However, you’ll pay less monthly interest on a shorter-term loan.

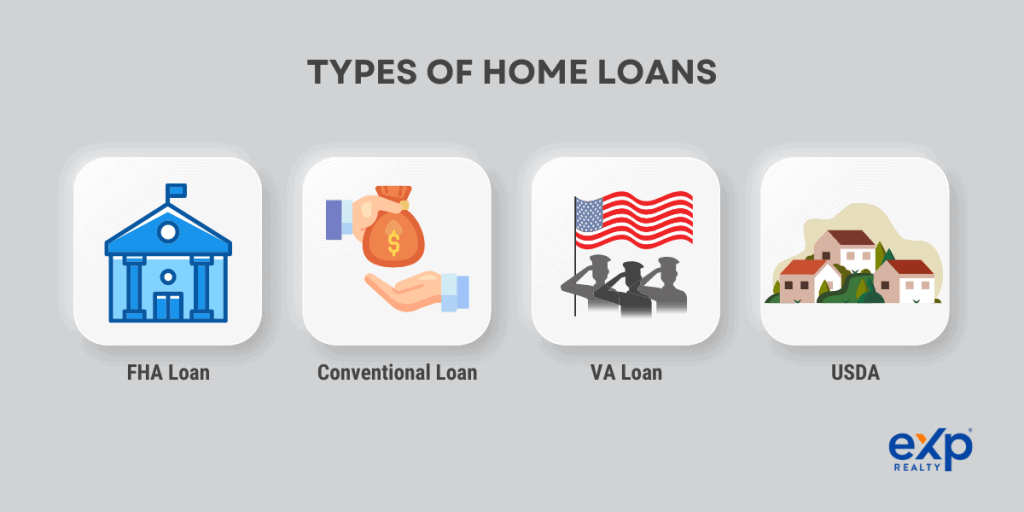

Loan Types

There are many different loan types to consider when buying a house.

- FHA Loan. An FHA loan is a government-backed loan designed to be accessible to people with special considerations like lower credit scores or small down payments. FHA loans generally tend to have higher interest rates than conventional mortgages. They also have stricter regulations regarding the type of property you can buy.

- Conventional loan. A conventional mortgage is not just one of the mortgage options; it’s any mortgage product that isn’t government-backed ( ie FHA, VA, or USDA). Conventional mortgages usually offer a lower interest rate but often require higher down payments and higher credit scores.

- VA Loan. A VA mortgage loan is backed by the Veterans Administration. It is available to those who have served in the Armed Forces or are currently on active duty. VA loans have many perks, including zero down payment, lower interest rates, and no monthly PMI.

- USDA. Only a few people are aware of USDA loans. Still, they can be an excellent option for someone who’s looking to purchase a home in a rural or semi-rural area. It offers a low down payment option and a few other perks. Still, the criteria for approval are tighter than for other types of loans.

The type of loan that’s best for you depends on many individual factors. You and your loan professional will review your options in-depth and determine which works best for you.

Start Your Home Search

So, you’ve received your pre-approval and are ready to start looking for a home! The first step is contacting a real estate agent. Your real estate agent will guide you during this hectic and exciting time and an invaluable part of the home-buying process.

They will send you information on houses that fit your budget and needs and take you on tours of properties you’re interested in.

A good realtor is attentive to your needs and willing to answer your questions. They have access to dozens of listings, including those just listed, as well as a network of other professionals with intimate knowledge of the housing market in your area.

Once you establish your home needs, your realtor will do their best to deliver. All you have to do is know what you’re looking for.

Finding the Right Realtor

Finding the right real estate agent should be an educated choice. Check out the realtor’s background, experience, and reviews.

One of the best ways to learn about local realtors is to ask friends and family. When people have a good experience with a realtor, they’re usually happy to let others know. It’s the same when they’ve had a less-than-stellar experience.

Gut instinct and chemistry also come into play. If you “click” with a specific realtor, like their manner, and feel that they understand your needs, it goes a long way in building a professional relationship.

Location, Location, Location!

Neighborhood research is a great place to start. Look at a map of the area you’re considering, and do some online sleuthing into the statistics of each town, village, or neighborhood in the designated area.

Some websites can help you learn more about any neighborhood you’re considering. They provide up-to-date facts and statistics that give you a snapshot of the area.

The biggest concerns for most buyers are the safety level of the neighborhood and its proximity to their job. If they work from home, as more workers do these days, the latter comes into play less.

Ultimately, what’s most important in a neighborhood will vary from person to person. For families with children, the school district rating and access to playgrounds usually top the list of priorities.

Young single professionals may put access to restaurants, bars, and other social spots ahead of other desires. For culturally oriented people, proximity to libraries, museums, and historical sites often takes precedence.

It would help if you had a few neighborhoods on your list of finalists, but try not to be rigid about it. You may find a fantastic home that has everything you want in a community you didn’t expect.

Making a List

Speaking of a fantastic home with everything you want, now is the time to make your list of home wants and needs. This is an integral part of preparing to buy a house.

Start with the needs, the non-negotiables you won’t compromise on. You may need a one-floor plan due to mobility issues or to be in a specific district so your child can continue to play in the local sports league.

These non-negotiables are different for everyone. It’s fine to have a few non-negotiables on your list, but stay focused; if you start mixing up needs and wants, you’re bound to be disappointed.

Your list of wants can be as long as you’d like. Interior design, colors, landscaping, and other aesthetic points are important to many buyers, as is the overall look and vibe of the neighborhood.

You’ll have to weigh your needs and wants and measure the pros and cons of every house you’ll view. It helps to bring your list when you are home-viewing, so you’ll have a visual guide to which ones check the most boxes.

For some home shoppers, it takes a while to find the property that’s perfect for them. Others get lucky and strike gold right away. The key is to have patience and be prepared for the next step.

Make an Offer

Once you’ve gone through the early steps of preparing to buy a house and explored your home options, you’ve finally found a place you adore. You’re ready to make an offer! The offer process is fairly straightforward.

- Pick a number. Decide on a fair price that’s within your budget. Your realtor will write up an offer to give the buyer.

An offer may contain contingencies; this means it may outline certain conditions that would allow you to back out of the offer under certain circumstances.For example, offers often have a contingency that says you can back out if the home inspection comes back with unforeseen issues.

- Earnest Money. When you make an offer, you must put down earnest money. This is a deposit that shows you’re serious about buying. The earnest money is technically part of your closing costs, usually around 1 or 2 percent of the offer.

- Seller’s Response. The owner will accept or reject your offer. If your offer is accepted, hooray! You’re on to the next step. If it’s rejected, it’s time to move on and look at another home. It’s common to experience a few rejections on your home-buying journey.

- Negotiation. Sometimes, the seller will make a counteroffer instead of rejecting or accepting your offer immediately. At that point, the ball is in your court. It’s your turn to accept, reject, or make another counteroffer.

You can negotiate prices, contingencies, date of closing, and other issues. Both you and the seller want the same thing: to be satisfied with the deal you’re getting.

It isn’t unusual to go back and forth like this a few times until both parties reach agreeable terms or decide to move on. If you can reach an agreement, you both sign a mutually binding contract to move forward with the sale.

Negotiations can be stressful to everyone involved, especially if you’ve set your heart on the home in question. Your realtor can be a great help during this phase. They’ve been through this process many times and can make it a smoother ride for you.

Inspection and Appraisal

Inspections and appraisals are essential steps to ensuring the value of the home you’re hoping to buy. When you’re preparing to buy a house, the inspection and appraisal happen after the seller accepts your offer.

Earlier in this section, you read about contingencies in a formal offer, one of which was the results of a home inspection.

Some first-time home buyers – particularly in competitive markets – may choose to waive the home inspection in their offer.

Waiving the home inspection in your offer doesn’t mean the home won’t be inspected; it means that you can’t use the inspection results to try and get a lower price or leverage other types of negotiations with the seller.

Inspections are vitally important because they give you a picture of the home’s actual condition and an idea of what kinds of repairs or revisions may be necessary should you decide to buy.

Some mortgage lenders require home inspections. For example, FHA inspections are known for being particularly thorough and strict.

An appraisal is different from a home inspection. An inspection is meant to ensure the safety and liveability of the home and to alert potential buyers to any serious issues.

On the other hand, an appraisal looks at the general condition, including the building materials and other details, and compares the home to other homes in the neighborhood in terms of value. It’s meant to ensure the home is sold at a fair and reasonable price.

Close the Sale

Throughout the home-buying experience, you will probably find yourself wondering – and asking your realtor – “when do we finally close?” Buying a house can be a long, drawn-out process, and it’s easy to grow impatient while you wait.

Once the house is in contract, it usually takes a couple of months to close. You’ll have been given an estimated closing date on your contract, but that’s not always set in stone unless a certain date was negotiated as a contingency.

During this time, there will be an inspection, an appraisal, and a title search. A title search ensures that the seller is free to sell you the house and that nobody else has rights to it or is owed money from it.

The mortgage lender will be going over your paperwork and processing your loan. They will send out documents during this time that need to be signed promptly. Some of these documents are called disclosures.

A disclosure has information about your loan, such as the term and interest rate. It also contains an estimate of your closing costs. Remember that in some cases, you will be sent multiple disclosures as your loan is being processed, and the numbers on these documents may change slightly.

During this time, avoid making any changes to your financial situation. Don’t quit your job, or open new lines of credit. Also, be sure to retain the required amount of money in your bank account to cover your closing costs.

With many types of loans, the lender will ask you for bank statements to show where your closing money came from.

You may be permitted to get some or all of your closing costs gifted to you by a family member, but the rules vary. Your mortgage professional will let you know the exact procedure you need to follow.

The Big Day

On closing day, you will go to a designated location – usually your lawyer’s office – to sign your papers. Your attorney will be there, as will the seller’s attorney.

Your realtor may also be present, as will be the mortgage lender’s representative, and escrow agent, who is often the attorney. You’ll pay the closing costs – usually by certified check – and sign all the documentation.

Suppose you can’t be present at the closing, for example, if you’re buying an out-of-state property. It is possible to do a long-distance close where you e-sign some of the paperwork and have some of it sent to you by overnight post.

After the closing, you’ll get the keys to your property and be able to access your new home. This truly exciting moment is worth all the paperwork, time, and effort.

Key Takeaways

Your key takeaways, when you’re preparing to buy a house, are as follows.

- Get your finances in order, including evaluating debt-to-income ratio, savings, assets, and credit score.

- Determine your home-buying budget

- Get pre-approved

- Decide what you want in a home

- Reach out to a realtor and start viewing houses

- Make an offer on a home you love

- Sign the contract

- Go through the mortgage approval and buying process

- Close on your new home

The home-buying experience can open our eyes to some important things, like how to better handle money, have patience, and negotiate for what we want.

Whether you’re buying your first home, a vacation home, or an investment property, there’s so much to learn when preparing to buy a house.

If you’re ready to buy a house, check out eXprealty for local real estate in your area! Contact a local eXp agent if you’re ready to buy your first home and make your experience the best it can be.

FAQs

If you’re still wondering what you need to do before buying a house, let’s take a look at the most commonly asked questions about how to buy a home below.

What are the 3 main steps to prepare for when buying a house?

There are many steps to buying a house, but if you need to pick just three, they would be financial preparation, seeking the help of a realtor, and cooperating with all the paperwork deadlines.

How do I financially prepare to buy a house?

Clean up your credit, decrease your debt-to-income ratio, and save for your down payment and other closing costs.

How much should you have saved up before buying a house?

That depends on how much your home-buying budget is and what type of loan you’re hoping to qualify for. Most conventional loans expect around 10 to 20% down payment, while loans like FHA require only 3% or sometimes less.

Your closing costs will include your home insurance, taxes, and processing fees for your loan. They may also include the down payment, but at other times the down payment is separate.

Closing costs generally add up to around 3% to 6% of your total loan amount. You can use that number plus the down payment amount to decide how much money you will need to save for your house.

What are 5 tips you recommend when purchasing a house?

- Work with an experienced real estate agent. Having a good agent on your side can make every part of the home-buying process easier.

- Be realistic. You may not find a house with every one of your desired features, in the neighborhood of your dreams, for a price that’s within your budget. But you can find a home that checks MOST of the necessary boxes and make the most of it.

- Have patience. From saving your money to working on your credit, right up to the stress and anticipation of closing, patience is a virtue that will pay off. Of course, if a stage of the process seems to be taking excessively long, check in with your realtor to ensure all is moving along as it should.

- Read the fine print. Whether you’re looking at a house disclosure, contract, or another document, be sure to understand the terms and conditions of what you’re agreeing to.

- Have fun! Touring houses and landing the one that feels like home is an awesome experience. Keep these beautiful moments from getting buried under the paperwork. Enjoy them!

How much is a downpayment on a 500k house?

If the loan you get allows for a downpayment of 3%, you would be paying $15,000 as a down payment. That’s separate from closing costs, which will likely run you at least that same amount. However, these numbers are just a loan estimate. It all depends on what loan program you go with.

What help do first-time buyers get?

First-time homebuyers can be eligible for a range of perks, including low or no down payment loans and specific types of loans or grants you don’t have to pay back. You usually have to fall into a certain financial bracket for the latter.

Local and state governments often have information about their special homebuyer programs. You can contact the Department of Housing and Urban Development (HUD) or do an online search for homebuyers’ assistance near you.

Many first-time buyer programs are also available from private lenders, so it’s a good idea to research your options in advance.

What is the average deposit for a first-time buyer?

The average deposit for a first-time buyer is around 6% of the home’s price, but many first-time buyers end up paying less than that. It depends on the type of loan you have.

What should you not forget when buying a house?

Remember to start preparing to buy a house well in advance! That way, you have time to get your finances straight and save thousands of dollars so you don’t run into surprises along the way.

What really matters when buying a house?

From a financial perspective, having a good credit score and a plan for funding the downpayment and closing costs. From a logistical standpoint, knowing what you want in a home and having patience with the process.

How much is a downpayment on a 200k house?

If your down payment is 3.5% (a typical down payment amount for government-backed loans like FHA), it would be $7,000.