When you enter the home buying process there are usually a handful of fees to be paid as soon as your offer is accepted. Though it’s not a requirement, it’s pretty standard practice to put down a “good faith” or earnest money deposit. Whether you’re buying a piece of real estate in San Antonio or any other city in the U.S., you’ll want to have a good understanding of what an earnest money deposit is and why you’re paying it before you start spending money.

What is the purpose of an earnest money deposit?

In a sense, an earnest money deposit is an amount paid to a title or escrow company the moment the offer is accepted and acts as insurance for both the buyers and sellers, and is also different from a down payment. When a buyer puts down an earnest money deposit, it helps the sellers see the buyers are serious about purchasing their home. Earnest money is also a way of protecting the seller if the buyer backs out of the deal. Usually when a home goes under contract, the sellers may stop home showings from other potential buyers as the property moves through the different stages of the home sale process.

Technically, an earnest money deposit isn’t a requirement. It is seen as a standard practice in the home buying process, though, and can help give buyers a leg up to the rest of the competition, especially in a seller’s market. It also helps the buyers because the earnest money sits in escrow and can be used towards the down payment or closing costs later on in the home buying process. If the home fails to pass inspection or any other contingencies or the seller backs out of the deal, the buyer can get their earnest money back.

How much should an earnest money deposit be?

There is no one set answer when determining how much an earnest money deposit should be. Your local real estate agent will help you determine a good price point for an earnest money deposit in your area. The amount that is expected can depend on the specific market a property is in and can be anywhere from $1 to 100% of the home price. A common amount is around 1% of the home price, but less than 1% is reasonable, too. Even when home prices are rising, the earnest money deposit stays about the same.

A more specific price range is anywhere from $1,500 to $3,000. Buyers markets may not require a big earnest money deposit, while in sellers markets you’ll typically see higher deposits since buyers are leveraging every aspect of their offer as possible.

How to get your earnest money back if the deal falls through

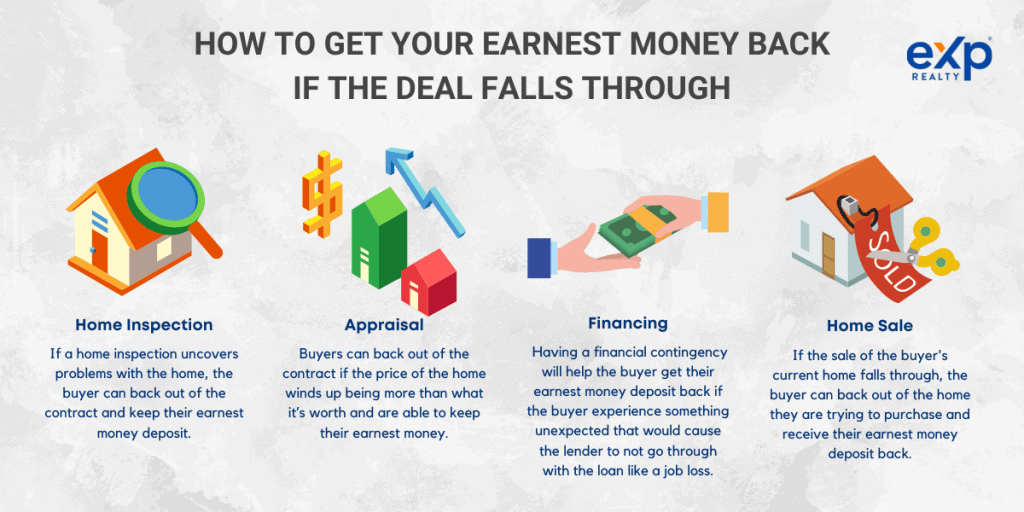

There are several reasons a buyer decides not to buy a home anymore and needs to back out of the contract. Depending on how the contract was written, with common contingencies, there are ways a buyer can get their earnest money back if the deal falls through. Let’s explore some of the most common scenarios.

Home Inspection

A home inspection happens during the first few days after a contract is executed (signed by both parties) and occurs during something called a due diligence or an option period. If a home inspection uncovers problems with the home, the buyers and sellers can work to resolve these issues, or the buyer can exercise the home inspection contingency by backing out of the contract and keeping their earnest money deposit.

Appraisal

One of the steps in the home buying process is for the lender to order an appraisal to determine how much the home is currently worth. The reason for doing this is because a lender wants to make sure they’re not lending more than what the property is worth in case the buyer defaults on the loan. With an appraisal contingency, buyers can back out of the contract if the price of the home winds up being more than what it’s worth and are able to keep their earnest money.

Financing

Whether you were preapproved for a mortgage before placing an offer and putting an earnest money deposit down or not, you never know what could happen between executing a contract and closing day. A buyer may experience a job loss or something else unexpected that would cause the lender to not go through with the loan. In that case, having a financial contingency will help the buyer get their earnest money deposit back.

Home Sale

Oftentimes buyers are selling a home at the same time. In this event, the buyers will present their offer with a home sale contingency. If their offer is accepted, the seller agrees to the terms that their transaction is dependent on the buyer’s current home selling first. If the sale of the buyer’s current home falls through, the buyer can back out of the home they are trying to purchase and receive their earnest money deposit back.

Securing your earnest money deposit

There are a lot of moving parts in a real estate transaction, so it’s important to be diligent every step of the way. One way to be diligent is to secure your earnest money deposit. Here is how you can know your earnest money deposit is safe:

- Only give your earnest money deposit to a title company or escrow company. Never give it to the seller or real estate agent.

- Know the contingencies in your contract. Not all the contingencies we’ve mentioned may be included in your contract. Sometimes in a seller’s market, you’ll want your offer to look as appealing as possible so you don’t include many contingencies to show how easy the home buying transaction will be with you. On the flip side, you don’t want to assume all the contingencies we’ve mentioned are standard for every transaction.

- Have everything in writing. It’s best practice to have everything documented and conversations noted, but most importantly you’ll want to make sure every contingency that is important to you to be included in the contract between you and the seller. That is arguably the most important step in making sure your earnest money deposit is safe.

- Know the timeline of events and stay on schedule. As with every home buying process, there are several things that need to happen in order for a buyer to close on their new home. You will want to make sure you get everything that is required of you completed in a timely manner so the timeline isn’t halted. Especially in the early stages when you’re dealing with home inspections in the due diligence/option periods.

What is an Earnest Money Deposit – Conclusion

We understand that buying a home can get hectic and stressful, especially when you don’t understand why you’re paying several fees or what they are. After reading this article about what an earnest money deposit is, we hope you have a better understanding of them and feel confident as you continue through the home buying process.