Embarking on the journey to homeownership can feel daunting, especially when understanding the financial aspects. A vital part of this journey is navigating the underwriting process, a term that might initially seem obscure but is crucial in home buying.

This guide will shed light on underwriting, unraveling its mysteries, and helping you understand its significance in the home-buying experience.

What is Underwriting?

As you prepare to make the most significant purchase of your life – your home – you’ll encounter various stages, including applying for a mortgage. Each step has its intricacies, from hunting for the right property and securing a loan to closing the deal. In this chain of processes, mortgage application underwriting and securities underwriting play a pivotal role.

In essence, underwriting is a term financial institutions use to evaluate a borrower’s creditworthiness and financial health to determine their eligibility for a mortgage. It’s the stage where mortgage lenders assess the level of risk they’re taking on before approving your conventional loan mortgage application.

Underwriting involves thoroughly reviewing your credit score, employment history, income ratio, and even the type of property you’re buying. Insurance underwriters are tasked with this evaluation to ensure the lender that the borrower can meet the mortgage payment obligations.

Underwriting Types

There are essentially two types of underwriting – manual and automated. Manual underwriting requires human underwriters to perform a detailed financial risk assessment. This process can benefit borrowers with unique financial circumstances, such as self-employment or atypical credit history.

Investment banks also play a crucial role in securities underwriting, facilitating the issuance of new securities through initial public offerings (IPOs) and other public offerings.

In contrast, automated underwriting uses advanced software to assess borrowers’ creditworthiness, allowing for a faster approval process. Despite the method employed, the underwriting process is robust to protect the borrower and the lending institution from potential financial risks.

Other Underwriting Contexts

Insurance

Apart from mortgage applications and securities underwriting, underwriting is essential to the insurance underwriting process. Insurance agents evaluate applicants’ medical history and other factors to determine insurance coverage and premiums for life insurance policies and other types of insurance.

Student Loans

Additionally, underwriting is crucial in the context of student loans, where lenders evaluate the creditworthiness of students and assess the risk before approving their loan applications.

Underwriting Value and Requirements

Regardless of the underwriting type, whether for a mortgage, insurance, securities, student loans, or types of insurance, the process is robust to protect both the borrower and the institution from potential financial risks.

Borrowers must provide various documents, such as bank accounts, business tax returns, and additional documents, to facilitate the underwriting process and ensure a thorough evaluation of their creditworthiness and financial situation.

Factors Considered During Underwriting

The underwriting process is not a random check; it systematically evaluates various factors associated with the borrower and the property. Here are the main components an underwriter examines:

Credit Score and Credit History

Your credit score is a numerical representation of your creditworthiness based on your financial history. It’s derived from your credit report, which includes the history of your credit cards, personal loans, auto loans, and other lines of credit. The higher your credit score, the lower risk you present to the lender.

Income and Employment History

Consistent income and stable employment history indicate your ability to meet monthly mortgage payments. Your tax returns, bank statements, and employment status can provide insight into your financial stability.

Assets and Liabilities

Underwriters will assess your total assets, including savings accounts, investment accounts, and real property, against your liabilities, such as outstanding debts, monthly payments, and other financial obligations.

Debt-to-Income Ratio (DTI)

DTI is the percentage of your gross monthly income that goes towards paying off debts. Lenders prefer a lower DTI ratio, indicating a good balance between income and debt.

Property Appraisal and Title Search

The lender must ensure the property’s purchase price aligns with its market value. An appraisal is carried out to establish this. A title search also provides no legal claims against the property.

Other factors could include the type of loan program, the size of your down payment, and the number of cash reserves you have.

Also, an appraisal of the property, including an inspection of the physical condition and comparison with similar properties, is a standard part of the underwriting process. Furthermore, some loan types, like FHA and VA loans, have specific underwriting guidelines that must be met.

The Role of Underwriting in Mortgage Approval

Underwriting is not just a term tossed around in the mortgage industry; it’s the backbone of the loan approval process. The mortgage underwriting process is where the rubber meets the road in home financing. At this stage, the loan underwriters meticulously analyze the loan application to ascertain if the borrower is a safe bet.

Your credit score, one of the pivotal factors, can significantly impact mortgage approval. A high credit score can open up opportunities for lower interest rates and favorable mortgage terms, while a low score can lead to higher rates or loan denial.

Similarly, your debt-to-income ratio (DTI) holds substantial weight. A lower DTI ratio is more favorable as it signals that you have sufficient income to manage your current debt obligations and the prospective mortgage payment.

Income and employment history lend a hand in painting a picture of your financial stability. Regular income and steady employment reassure the lender of your ability to meet the mortgage payments. Additionally, your assets and liabilities are reviewed to evaluate your financial health. A significant number of assets than liabilities is typically seen as a positive sign.

Assets encompass liquid assets like savings and investments, including real estate, vehicles, and personal property. High-value assets can be used to pay off your loan if you face financial difficulties. On the other hand, liabilities include your current debt and ongoing expenses like alimony, child support, or legal judgments, which can impact your ability to pay off a mortgage.

The underwriting process’s significance must be recognized, as the approval of your mortgage loan application is contingent on its outcome. This comprehensive process validates your financial credentials and ensures the property you’re buying is a worthwhile investment.

Another significant facet of underwriting is the Loan-to-Value ratio (LTV), which compares the loan amount with the property’s value. Moreover, potential red flags like bankruptcy or foreclosure in the borrower’s past can influence underwriting decisions.

By verifying the legality of the title and appraising the property’s worth, the underwriting process safeguards your interest and the lender’s. Mortgage underwriters also play a crucial role in setting the terms of your loan. They determine your loan’s interest rate, term, and amount, based on the level of risk they assess you and the property to present.

In some cases, underwriters can also decide the requirement for an escrow account, a third-party account used to pay property taxes and homeowners insurance. They may also evaluate whether any seller concessions or down payment gifts can be included in the loan agreement. All these decisions are based on the borrower’s risk profile and the property.

Potential Underwriting Issues

While the underwriting process is relatively standardized, each loan application is unique, and various issues may arise during the review. Common problems include inaccurate or incomplete information in the loan application, credit issues like a low credit score or a history of late payments, and income issues such as irregular or unverifiable income.

Here are some strategies to navigate through these potential issues:

Foster Communication

Maintaining open and regular communication with your lender is crucial for navigating potential underwriting issues. Any changes in your financial situation, job, or anything else that might impact your loan application should be promptly communicated to the underwriter.

Thorough Documentation

Be ready to provide thorough documentation for every information you provide in your loan application. This step includes proof of income, tax returns, bank statements, and more. Ensuring every claim is substantiated speeds up the process and builds credibility with the underwriter.

Manage Your Debt

Keeping an eye on your existing debt is critical. Ensure you have a manageable amount of debt relative to your income. If your debt-to-income ratio is high, it may be beneficial to pay down some debt before applying for a mortgage.

Get Pre-approved

Pre-approval involves a preliminary underwriting process where the lender gives a tentative commitment based on your financial situation. It gives you an edge in the competitive real estate market and highlights potential issues upfront.

Honesty and Accuracy

Providing accurate and honest information during the loan application can save you from unnecessary delays and potential loan denial.

Maintain Good Credit

Pay your bills on time, avoid taking on more debt, and keep your credit card balances low to maintain a good credit score.

Avoid Large Purchases

Any large purchase can impact your DTI ratio, potentially affecting your mortgage eligibility.

Stay Current

Staying current with all your financial obligations is crucial. Any late payments, delinquencies, or charge-offs during the loan process could jeopardize your mortgage approval. Additionally, fluctuations in your financial situation during the loan approval process can create issues.

Compliance with Underwriting Guidelines

Lenders have specific guidelines that a property must meet to qualify for a mortgage. This step includes safety and health guidelines, among others. Ensure the property you’re interested in complies with these guidelines before moving forward.

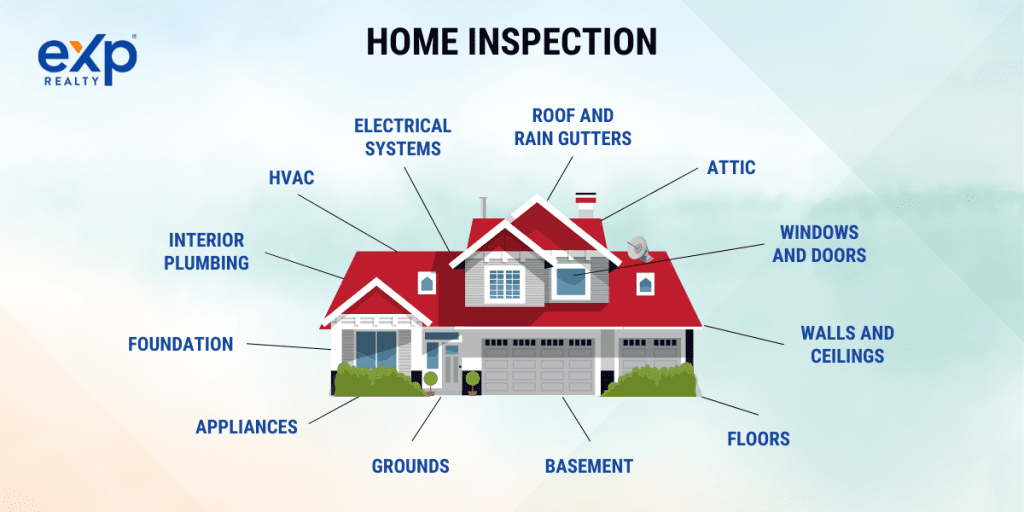

Home Inspection

Getting a thorough home inspection before the underwriting process begins is advisable. This step can reveal potential issues with the property that could affect its value or lead to costly repairs in the future. Addressing these issues can save time and avoid complications during underwriting.

To ensure a smoother underwriting process, consider the option of credit counseling or financial planning. These services can help you understand your credit report, rectify inaccuracies, and make informed decisions to enhance your financial health, paving the way for a smoother underwriting experience.

Key Takeaways

The underwriting process might seem complex and intimidating, but its role is fundamental in securing your home loan. As the gatekeeper to your mortgage approval, understanding underwriting can empower you to better prepare for your home-buying journey.

Are you ready to find your dream home? Start your search for properties and find your desired location. Our local eXp agents are just a click away if you have questions or need guidance. Start your home-buying journey with confidence today!

FAQS: Underwriting

What is underwriting in simple terms?

Underwriting is evaluating and assessing the risk of insuring or lending money to someone.

What is the primary purpose of underwriting?

The primary purpose of underwriting is to determine whether an applicant meets the necessary criteria and assess the risk associated with insuring or lending to them.

What is an example of underwriting?

An example of underwriting is when an insurance company evaluates an individual’s health condition and other factors to determine the premium for a health insurance policy.

What is the process of underwriting?

Underwriting involves gathering and analyzing information about the applicant’s financial status, creditworthiness, and other relevant factors to decide whether to approve or deny an application for insurance or a loan.

What is the most critical factor in underwriting?

The most crucial factor in underwriting typically depends on the type of underwriting being conducted; for example, in mortgage underwriting, the applicant’s credit history, income, and debt-to-income ratio are crucial factors.

Is underwriting the same as closing?

No, underwriting and closing are different stages in the loan approval process. Underwriting comes before closing and involves the evaluation of the applicant’s eligibility and risk. At the same time, closing is the final step, where all necessary documents are signed, and the loan is funded.

How long does it take for the underwriter to make a decision?

The time it takes for an underwriter to make a decision varies depending on the complexity of the application and the volume of applications being processed. Still, it generally takes a few days to a few weeks.

Can a loan be denied in underwriting?

Yes, a loan can be denied in underwriting if the applicant fails to meet the required criteria or if the underwriter identifies significant risks that the lender is unwilling to accept.