Buying a home is a lengthy and expensive process, so it’s crucial that you know all of your options for keeping things as affordable as possible. Of course, closing costs can look different when buying San Francisco real estate versus Nashville real estate, but in either scenario, it’s helpful to know your options to keep as much cash in your pocket as possible. Sometimes this looks like simply buying a home that costs less, but other times it looks like negotiating with the home buyer on excess costs.

In short, seller concessions are a way for a homebuyer to save on their buying costs by negotiating for the seller to cover certain closing costs. What do those costs include? How do you even begin to negotiate seller concessions? We have all those answers and more, so keep reading below.

What are Closing Costs?

Before we dive into seller concessions, it’s important to clear up what closing costs are and why it’s important to implement them in the first place. Closing costs are the fees you pay your lender before you officially close on your home. In exchange for creating your loan, lenders will charge you these processing fees to cover factors like a home appraisal or a search on your home’s title.

The amount you pay in closing costs depends on what kind of loan you get and the state you buy the home in, but they generally make up 3%-6% of the loan amount. For example, if you take out a $250,000 mortgage loan, the closing cost should be around $7,500 – $15,000.

What is a Seller Concession?

Now that we covered what closing costs are, what is a seller concession? Seller concessions are specific closing costs that the seller agrees to pay. As a buyer, with the help of your real estate agent, you can negotiate for the seller to pay either a percentage of the closing costs or one or more specific closing costs.

This isn’t a common occurrence, though, especially in a seller’s market, so make sure you study the state of the market and chat with your agent before deciding to ask for a seller concession. In fact, one of the questions to ask before hiring your real estate agent could be if they have negotiated seller concessions before.

What Costs Can Be Included in Seller Concessions?

While it varies state by state, the following are costs that the seller can cover when closing as a part of their seller concession:

- Property taxes: These are pre-paid property taxes through the end of the year.

- Inspection fees: In some cases, a lender will require a home inspection before closing. Inspection fees are whatever costs come with the inspection process.

- Attorney’s fees: If you need an attorney present at closing, or if the state requires it, these fees will cover that cost.

- Recording fees: The fees charged for recording the purchase of your home for the local government.

- Appraisal fee: When a third-party appraiser evaluates the market value of your home, the appraisal fee will cover the cost.

- Title insurance: Title insurance protects both you and your lender if someone else tries to claim your home’s title.

- Loan origination fees: The lender’s charges for processing your loan.

- Discount points: Interest you pay to your lender upfront to avoid increasing interest later.

Once you have applied for a loan, your lender will show you your estimated closing costs as required by both the lender and the state. You and your real estate agent can then decide what percentage or which closing costs to ask the seller to pay for.

How to Negotiate Seller Concessions

How do you even begin to negotiate a seller concessions agreement? A lot is involved in asking for a seller concession, and not every real estate transaction properly sets the scene for one. We highly recommend working through this with your local real estate agent, but here are three initial steps to take when negotiating seller concessions:

- Study the current real estate market: Asking for a seller concession is all about understanding the current market conditions and using them to negotiate. Note how much other local homes are listing and selling for, and ask your agent if there have been other recent transactions in the area with seller concessions.

- Determine whether you’re in a buyer’s market or seller’s market: Sellers are much more likely to agree to a seller concession if their house has been stagnant on the market for a while or if they’re in a rush and have only gotten a couple of offers. You have a better chance of getting a seller concession agreement in a buyers market than if your seller has 10 offers a day that is $50K above the asking price.

- Limit other demands: If you are asking for a seller concession, you generally have less room to negotiate other demands. If you are planning on asking for a seller concession and ask for 3 different home repairs and additional lawn servicing before closing, you can also plan on that seller backing out of your transaction in an instant.

When Would a Seller Agree to a Concession?

It may not initially make much sense on the seller’s part to agree to a concession, but there are a few scenarios where it’s financially wise for the seller to do so. One circumstance where a seller may agree to a seller concession is if they are buying and selling a home at the same time and want to complete the sale quickly to avoid paying multiple mortgages. Another reason for a sellers concession agreement is if the house has been on the market for a long time, and they are not getting enough offers to justify turning down yours.

Most of the situations that would cause a seller to agree to a seller concession are caused by an ongoing buyers market, so, once again, study where your local real estate market is going and work with your real estate agent to determine if it’s a wise choice to ask for one.

Pros and Cons of Asking for Seller Concessions

Pros for Buyers

The advantages of seller concessions for buyers are clear; you pay less on your closing costs! Depending on loan type and down payment, buyers could cover up to 9% of their closing costs, which can make a huge financial impact.

Pros for Sellers

For sellers, agreeing to a seller concession can get their homes sold faster, and they may be able to raise their initial asking price in return for covering some of the closing costs. This is all a part of the negotiation process, which is just as crucial for sellers as it is for buyers.

Cons for Buyers

On the buyer’s part, the most obvious disadvantage of asking for seller concessions is that you may lose your chance at the house. If a seller has several other offers and you ask for a seller concession, they may decide to nix your offer altogether in favor of another one on standby. This is why it’s crucial to research the wider market and the particular house before trying to negotiate.

Another con for buyers when asking for sellers’ concessions is you often lose your chance of having any repairs or restoration done if there is a need for some. If your seller agrees to pay for 4% of your closing costs, there’s little chance they’ll also agree to fix the basement wall’s cracks or replace a faulty appliance.

Cons for Sellers

The main disadvantage of a seller concession for sellers is that they have to spend additional cash on the sale of their home that they could have otherwise kept. More often than not, if a seller agrees to a concession, the pros of the agreement far outweigh this con. However, it is possible to get caught in a position where you have no choice but to concede and move forward with the sale.

Seller Concession Limits

Let’s say you study the market, have the upper hand as a buyer, and are ready to negotiate your seller concessions. You can’t simply ask for a whopping 20% of the closing costs and call it a day; seller concessions have limits. These limits are set to avoid rising inflation in the housing market and vary from loan to loan.

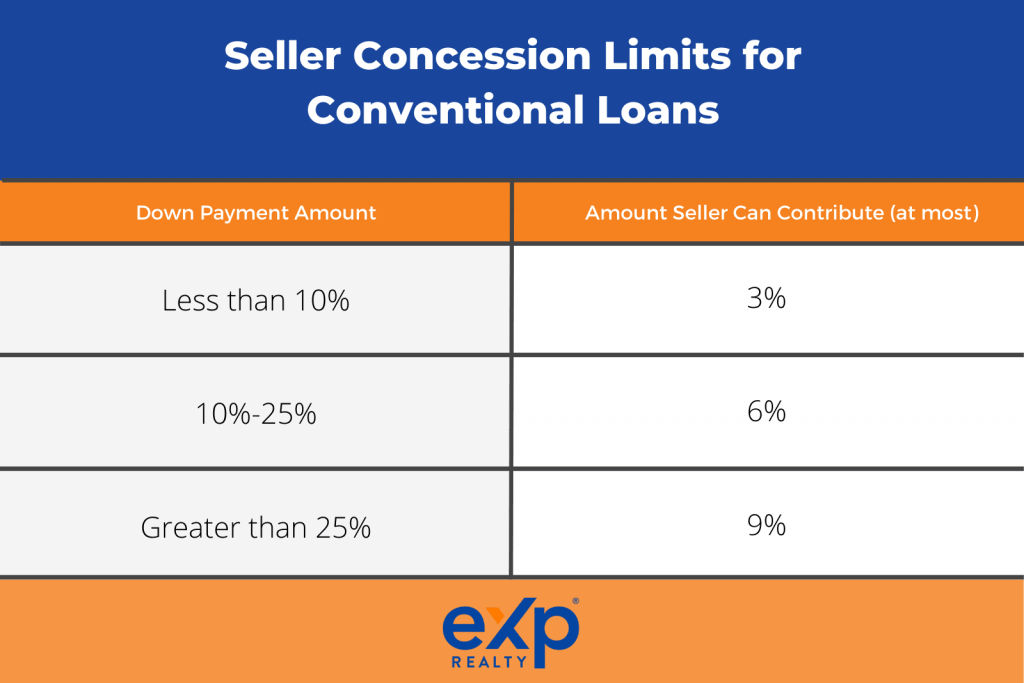

Conventional Loans

Conventional loans are issued by private mortgage lenders, are not government-backed, and are the most common type of mortgage loan.

*For investment properties, the seller can only contribute up to 2% regardless of home price and down payment amount.

FHA Loans

FHA loans are issued by the Federal Housing Administration and allow a homebuyer to make a down payment of as low as 3.5% with less strict credit requirements than conventional loans.

For FHA loans, the seller can contribute up to 6% of closing costs.

USDA Loans

A USDA loan is for eligible rural homebuyers and offers a zero down payment mortgage. The seller concession limit for a USDA loan is a fixed percentage and is not dependent on appraisal value or purchase price.

For USDA loans, the seller can contribute up to 6% of closing costs.

VA Loans

VA loans allow active-duty and retired service members and surviving spouses to finance their home without a down payment, mortgage insurance, or strict credit requirements. For buyers with VA loans, sellers can contribute to things like a buyer’s judgments and debts or any VA funding fees.

For VA loans, the seller can contribute up to 4% of closing costs.

Are There Tax Consequences for Seller Concessions?

For the most part, seller concessions don’t have any tax implications and aren’t tax deductible on the seller’s part. However, every individual situation is different and we highly recommend discussing your seller concession negotiations with your tax advisor before making any major moves.

Most closing costs are not tax deductible, regardless of whether the buyer or seller is paying them. At the moment, home mortgage interest (including discount points) and some property taxes are the only closing costs that may be deductible.

Conclusion: What is a Seller Concession?

We hope you not only understand seller concessions a bit more but that you also have an idea of the limits, implications, and processes involved in asking for one. Our biggest piece of advice is to work closely with your real estate agent and gain a deep understanding of the current real estate market. Using cash to buy your home? An excellent read for you may be our step-by-step guide on buying a home with cash.