Navigating the world of real estate and mortgages after bankruptcy may seem disconcerting. However, buying a house after bankruptcy is entirely feasible with careful planning, rebuilding your bad credit, and patience.

Whether you’re looking for modern condos in Miami, or suburban houses for sale in Boston, we invite you to explore the extensive property listings, where you can find various options that can fit your needs and budget.

So, when can you buy a house after bankruptcy? In this article, we’ll explore the topic and answer all of your questions.

Understanding Bankruptcy

Bankruptcy is a legal action taken by individuals or businesses unable to meet their outstanding debts. It allows for the restructuring or discharging debts, providing a fresh start to those overwhelmed by their financial obligations. However, it also comes with its share of challenges, one being its effect on your credit score.

As a prospective homebuyer post – bankruptcy, it’s crucial to comprehend the intricacies of bankruptcy and how it can impact your chances of buying a house. After a bankruptcy filing, your credit history may not be perfect, but don’t let this deter you from exploring the possibility of homeownership.

Depending on the type of bankruptcy filing—Chapter 7 (Liquidation Bankruptcy) or Chapter 13 (Repayment Plan Bankruptcy)—it may stay on your credit report for 7 to 10 years. Nevertheless, this doesn’t mean you need to wait this long to buy a home.

While the bankruptcy remains a black mark on your credit report, its impact lessens over time, especially if you make regular payments and keep your financial health in check.

Understanding the details of homebuying after bankruptcy is vital to navigate the process, find the right type of loan, and avoid future financial mismanagement. The right knowledge will empower you to move past the bankruptcy mark and step confidently into homeownership.

We’ll delve into the timelines related to how long bankruptcy stays on your credit reports, the mandatory waiting periods for different loan types, and how to rebuild your credit history effectively.

Preparing to Buy a Home After Bankruptcy

Preparing to buy a home after bankruptcy involves key steps that will put you on the path to homeownership. This preparation stage involves a mix of budgeting, saving, and credit-building measures, along with selecting a trustworthy mortgage lender.

Building your credit and savings is paramount after filing bankruptcy. Remember, credit scores play a significant role in a lender’s decision to approve your mortgage application.

Credit bureaus track your financial behavior and update your credit history accordingly, influencing your credit score. The key to improving this score lies in making your payments on time. This includes your credit card payments and all regular payments, such as your cell phone payments and other monthly payments.

Ways to Rebuild Credit

A secured credit card or an installment loan can be an excellent start to building your credit after bankruptcy. These credit lines can provide a platform to demonstrate your ability to manage credit responsibly. Remember to keep your credit card balance well below your credit limit to impact your credit score positively.

Simultaneously, establishing a robust savings habit is equally important. It demonstrates your financial stability and readiness to handle a mortgage. Plus, the more you save, the larger the down payment you can afford, potentially resulting in lower monthly mortgage payments.

Realistic Budget and a Reputable Lender

Finding a reputable lender is another crucial aspect of the home buying process. Different mortgage lenders may offer different loan products, each with its own loan requirements, interest rates, and terms. Therefore, research and compare your options, considering factors like the lender’s reputation, customer service, and the overall loan cost.

Establishing a realistic budget is an essential step. Your budget should consider the mortgage payment and other associated costs like property taxes, home insurance payments, maintenance costs, and possible homeowner association fees.

Tools like online mortgage calculators can help you estimate your monthly mortgage payment and understand how much house you can afford.

Bans on Borrowers

Bans on borrowers in the context of bankruptcy refer to restrictions imposed on individuals or businesses that have filed for bankruptcy. These bans are intended to prevent abuse of the bankruptcy system and promote responsible financial behavior. When someone is banned, it means they are prohibited from taking on new debts or applying for credit during the bankruptcy process.

These bans serve as a safeguard, ensuring that individuals focus on resolving their existing debts rather than accumulating new ones. By restricting borrowing, these bans encourage responsible financial management and provide a framework for individuals to regain control of their financial situations before seeking a fresh start.

Adjustable Interest Rates

Adjustable interest rates, also known as variable rates, refer to loan terms where the interest fluctuates over time. They are like a double-edged sword, offering potential benefits and risks.

On one hand, they can provide initial lower payments, boosting affordability. On the other, they expose borrowers to uncertainty, as rates can rise unexpectedly, leading to higher payments.

When rates soar, individuals and businesses with adjustable-rate loans may struggle to keep up, leading to a catastrophic increase of the risk of financial strain and potential bankruptcy filings. Therefore, it is crucial for borrowers to carefully assess their financial capabilities and consider the long-term implications of adjustable interest rates to avoid potential pitfalls.

Home Buying Options After Bankruptcy

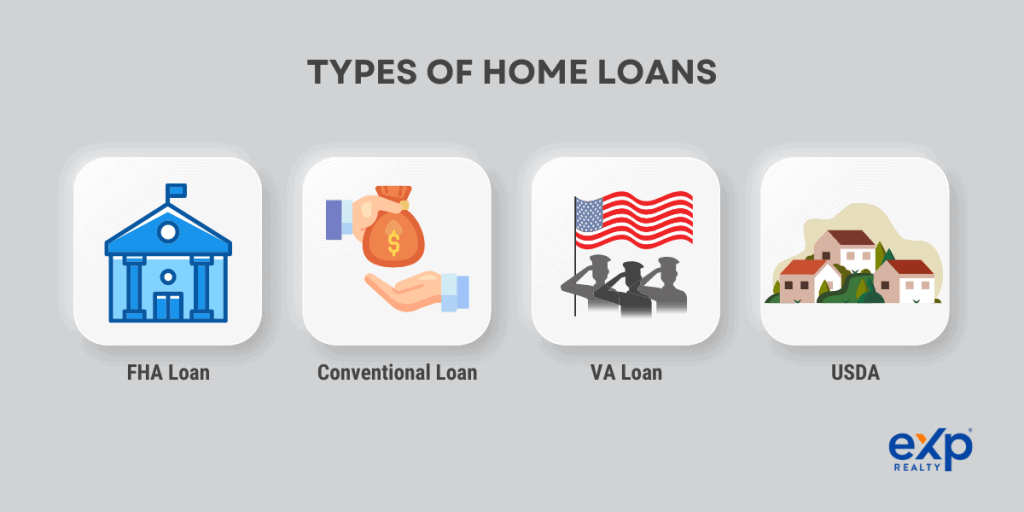

Once you’ve taken steps to rebuild your credit, save, and establish a budget, it’s time to explore your home buying options. Depending on your credit score, income, and the time since your bankruptcy discharge, different types of mortgage loans could be available to you.

- Conventional loans are a common type of mortgage offered by private lenders and often require a higher credit score and a larger down payment. While conventional loans often have more stringent requirements, they typically offer some of the lowest interest rates for those with a good credit history.

- Government-backed loans like FHA (Federal Housing Administration), VA (U.S. Department of Veterans Affairs), and USDA (United States Department of Agriculture) loans are other viable options.

The government-backed loans are designed to make homeownership more accessible and often have lower credit score requirements and minimum down payments. FHA loans, for instance, are popular among first-time homebuyers and those with a poor credit score, given their comparatively lenient credit requirements.

Moreover, VA loans, available to service members, veterans, and eligible surviving spouses, offer benefits like no down payment and no requirement for mortgage insurance. USDA loans are aimed at promoting homeownership in rural areas, and for eligible individuals, they can offer 100% financing.

Finding good mortgage rates after filing for bankruptcy can be challenging but not impossible. Start by rebuilding your credit score and demonstrating responsible financial behavior. Shop around for lenders who specialize in working with individuals who have gone through bankruptcy. Compare rates, terms, and fees to make an informed decision about your mortgage rate.

Timing Your Home Buying After Bankruptcy

Timing plays a critical role when buying a home after bankruptcy. Patience, strategic planning, and focused effort during the minimum waiting period post-bankruptcy can significantly enhance your homebuying prospects.

Following a bankruptcy discharge, there are mandatory waiting periods before you are eligible to apply for a mortgage. These periods, also known as “seasoning periods,” vary depending on the type of bankruptcy filed (Chapter 7 or Chapter 13) and the type of loan you are considering.

‘Seasoning Period’ Example

For example, for a conventional mortgage loan, the waiting period may be up to four years, while for an FHA or VA loan, the waiting period may be shorter, often around two years. It’s important to note that these waiting periods begin from the date of your bankruptcy discharge, not the filing date.

This waiting period is not simply a countdown. Rather, consider it a valuable window of opportunity to rebuild your financial health and boost your credit score.

The Impact of a Healthy Credit Score

Your credit score is one of the key factors that mortgage lenders evaluate when assessing your loan application. A higher score can enhance your chances of approval and help you secure the lowest interest rate possible.

To improve your credit score, make all your payments on time, from your credit card bills to your medical bills. Even one missed payment can have a significant impact on your credit score. Other ways to make your credit score healthier include:

Diversity

Building a diverse credit profile can also help improve your score. This might include a mix of credit types, such as a credit card, an installment loan, or a personal loan.

Low Utilization

Keep your credit utilization low, ideally below 30% of your available credit limit, as high utilization can negatively impact your score.

Keep it Up to Date

Monitor your credit report regularly. You can request a free annual report from the three major credit bureaus. Review these reports to ensure all information is accurate and up-to-date.

Save as Much as You Can

Moreover, try to save as much as possible during this period. A larger down payment can reduce your monthly mortgage payments and demonstrate to lenders that you are financially prepared for homeownership.

A bankruptcy mark on your credit report is not a permanent black mark against homeownership. You can time your home buying journey effectively with patience and diligent effort towards improving your credit score.

You are not just a bankruptcy filer, but a potential homeowner. Use this time wisely to prepare yourself financially and mentally for the next big step in your life. Always remember, good things come to those who wait and prepare. The dream of owning your own home after bankruptcy is no exception.

Working with Real Estate Professionals After Bankruptcy

As you navigate the path to homeownership after bankruptcy, having the right team on your side can make all the difference. Enlisting the help of a seasoned real estate agent, especially one with experience assisting buyers post-bankruptcy, can be a game-changer.

A knowledgeable real estate agent can guide you through the homebuying journey, providing sound advice at each step of the entire process. They can help you understand the housing market, identify the right properties within your budget, and negotiate effectively on your behalf.

Honesty and transparency are paramount in this journey. Be upfront about your financial history and current situation with your real estate agent, mortgage lenders, and sellers. They need this information to provide the best advice and options suited to your circumstances.

For instance, discussing your bankruptcy filing with a lender can give them a better understanding of your situation, which may affect the terms of your loan or mortgage application process.

A reliable and understanding real estate agent can be a trusted ally in your journey to homeownership. They can connect you with suitable lenders and loan programs and help you find a home that fits your budget and preferences.

Don’t hesitate to contact a local eXp agent in your area for professional assistance in this important phase of your financial recovery.

Final Thoughts

Navigating the journey to homeownership after bankruptcy may seem daunting. However, it’s important to remember that bankruptcy is not a financial life sentence. With strategic planning, patience, and determination, you can regain your credit and become a homeowner.

Don’t hesitate to seek professional advice if you have any questions or uncertainties. An eXp agent can help sort out concerns you have with properties. Lawyers, credit counselors, bankruptcy attorneys, mortgage advisors, and real estate agents can provide invaluable assistance. Their experience and expertise can help you avoid pitfalls and make informed decisions.

Are you ready to take the next step in your home buying journey after bankruptcy? Then don’t wait, sign up to get alerts of new property listings when they come on the market and contact a local eXp agent! They are ready and eager to guide you through your home buying process, providing the advice and support you need to find and secure your dream home.

FAQs: When Can You Buy a House After Bankruptcy

As you prepare to buy a home after bankruptcy, it’s natural to have many questions. Here are some of the most frequently asked questions sourced from Google’s People Also Ask feature and various online forums. Let’s address these to clear any remaining doubts you may have.

If I file for bankruptcy can I still buy a home?

Yes, you can still buy a home after filing for bankruptcy. However, a mandatory waiting period will be before you can get a mortgage. The length of this period depends on the type of bankruptcy you filed (Chapter 7 or Chapter 13) and the type of loan you are considering (conventional, FHA, VA, USDA). After this waiting period and with appropriate financial planning, you can successfully apply for a mortgage and buy a home.

How long do you have to wait to get a home loan after bankruptcy?

The waiting period for a home loan after bankruptcy varies depending on the type of bankruptcy and the type of loan. For Chapter 7 bankruptcy, the waiting periods can range from two years for FHA and VA loans to four years for conventional loans. Chapter 13 bankruptcy has a shorter waiting period, ranging from one year for FHA and VA loans to two years for conventional loans. These periods begin after the discharge or dismissal of the bankruptcy.

How long after Chapter 7 can I get a FHA mortgage?

FHA loans have a mandatory two-year waiting period after the discharge of a Chapter 7 bankruptcy. However, it’s worth noting that maintaining a good credit history during this waiting period can increase your chances of loan approval.

Do I have to wait two years to buy a house after bankruptcy?

The 2-year waiting period is generally for FHA and VA loans after a Chapter 7 bankruptcy. Conventional loans typically require a longer waiting period, while Chapter 13 bankruptcy has a shorter waiting period.

What credit score is good for buying a house?

Most mortgage lenders require a minimum credit score of 620 for conventional loans. The minimum credit score required for FHA loans is typically 580 if you have a 3.5% down payment. However, having a higher credit score can result in better loan terms and interest rates.

How do you rebuild after bankruptcy?

Rebuilding after bankruptcy involves careful financial planning. Start by creating a realistic budget, making all your payments on time, and gradually saving money. Opening a secured credit card or installment loan can help rebuild your credit. Always pay your bills on time and keep your credit utilization low.

Over time, these actions can help increase your credit score and improve your chances of qualifying for a mortgage. It’s also recommended to consult with financial professionals for guidance during this process.