Are you considering investing in real estate? Whether you’re a first-time buyer or a seasoned investor, it’s important to conduct your due diligence. Due diligence is a critical process in real estate that involves researching and verifying information about a property before making a purchase, it doesn’t matter if you’re buying a condo, a townhouse, or a single-family home.

In this article, we’ll delve into the meaning of due diligence in real estate and why it’s so important. We’ll also discuss the key elements of due diligence and what you should look out for when conducting your own investigation.

What Does Due Diligence Mean in Real Estate?

Due diligence refers to conducting a property investigation before purchasing a property. The due diligence process involves gathering necessary information about a property to make an informed decision about its value, condition, and potential risks that may affect the transaction.

The Key Benefits of Conducting Due Diligence

Here are some key benefits of conducting due diligence.

Minimizes Risk for the Buyer

When a buyer conducts a due diligence process, they thoroughly investigate the targeted asset plus the seller’s profile. The investigation covers many areas, including the seller’s financials, operations, and legal compliance. Buyers can then identify potential risks impacting the transaction’s success by thoroughly investigating these areas.

Helps Determine the True Value of the Property

During due diligence, various aspects of the property get assessed. They include the physical condition of the property and legal issues related to the property. By examining these factors, a buyer determines the property’s value and identifies potential problems that may affect its value.

By conducting due diligence, these issues get identified early on, allowing the investor to negotiate a better purchase price or avoid investing in the asset.

Helps Identify Potential Problems Before the Closing

Before the closing process of a deal, you should thoroughly examine the target seller’s company or property. This examination includes analyzing financial statements, reviewing legal documents (you can get the assistance of a real estate attorney), assessing the company’s management team, and evaluating market conditions.

By conducting due diligence, investors get a complete picture of the target and identify potential problems that may impact the transaction. The potential problems include legal issues, environmental concerns, pending litigation, and tax liabilities.

Identifying potential problems before closing allows investors to renegotiate the terms of the deal or request additional due diligence.

What Happens During the Due Diligence Period

Here are some of the things that happen during the due diligence period.

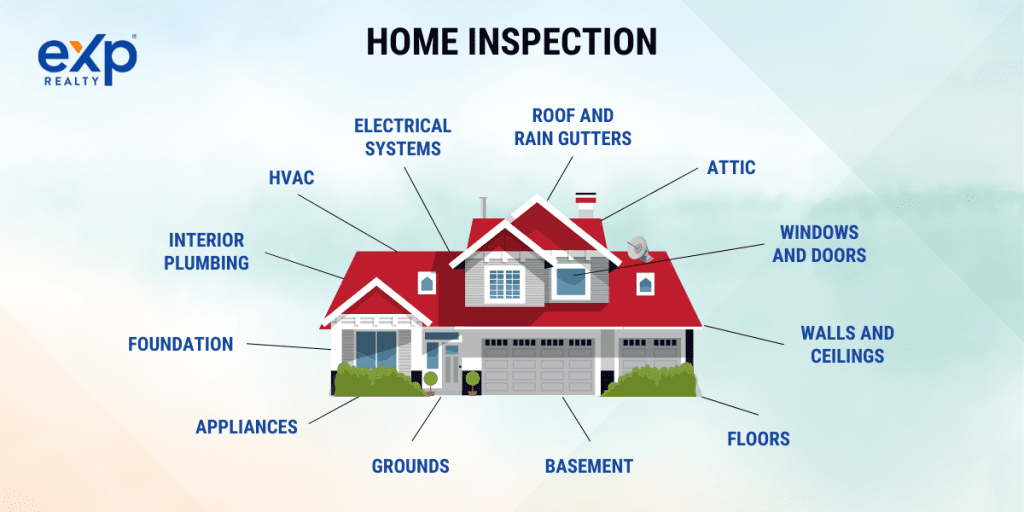

Home Inspection

During the due diligence period, a home inspection assesses the condition of a property before the sale. A professional home inspector carries out the home inspection and examines various systems and components of the home. These components include plumbing, electrical, heating, and cooling systems.

The home inspection aims to identify defects in the property that could affect its value or pose a safety hazard to the occupants.

Appraisal

An appraisal helps determine the asset’s fair value during due diligence. It involves thoroughly analyzing financial statements, physical assets, intellectual property, customer base, and other relevant factors.

The process enables the acquiring party to assess the target asset’s appraised value, which informs negotiations and pricing. A third-party appraiser specializing in valuing assets can conduct the process.

Title Search

A title search examines public records to ensure the seller has the legal right to sell the property. With a title search, no outstanding liens, claims, or encumbrances could affect the buyer’s ownership or use of the property.

The title search includes a review of deeds, mortgages, trusts, probate records, and court judgments to verify that the seller has a marketable title to the property.

The title search also includes a review of any outstanding liens or encumbrances, such as unpaid taxes, mortgages, or judgments against the property. These items must get resolved before the sale by paying off the outstanding debt or obtaining a release of the lien or encumbrance.

Land Survey

A land survey provides a clear understanding of the property’s physical boundaries and any potential issues or limitations that may affect its use. The land survey can also uncover boundary disputes, which could have legal implications and impact the property’s value.

Disclosures

During the due diligence period, both parties should make certain disclosures. These disclosures take various forms, such as written or verbal disclosures.

The seller should disclose potential liabilities, outstanding lawsuits, and risks that could impact the buyer’s decision. On the other hand, the buyer should also disclose financial capabilities and potential conflicts of interest.

HOA Rules

During the due diligence period, the rules and regulations of a homeowners association (HOA) are still in effect. The buyer should carefully review the HOA’s rules and regulations to ensure they are comfortable before purchasing.

Zoning Rules

You must carefully review the zoning rules and regulations that apply to the property in question. Zoning rules are laws that regulate land use within a specific area. These rules significantly impact a property’s potential use and development. You must thus understand them before completing a real estate transaction.

Insurance

You must assess and understand any homeowners insurance coverage that is in place for the assets you intend to acquire. It includes reviewing insurance policies, coverage limits, and exclusions to ensure the buyer knows the potential risks and liabilities associated with the acquisition.

Types of Due Diligence in Real Estate

In real estate, several types of due diligence help ensure a transaction is efficient and prevent mistakes. Here are common types of due diligence in real estate.

Legal Due Diligence

Legal due diligence examines real estate transactions’ legal and regulatory risks. It aims to identify potential problems that could hurt the trade or the parties involved and determine how these issues can be addressed or mitigated.

Review of Title Report and Deed

When conducting legal due diligence, two critical documents reviewed are the title report and the deed. The title report is a document that provides information on the legal ownership of a property. This report verifies that the seller has a clear and marketable title to the property.

On the other hand, the deed is a legal document that transfers property ownership from the seller (previous owner) to the buyer.

Zoning and Land Use Analysis

Zoning and land use analysis identify potential legal issues or restrictions impacting the property’s intended use. A qualified legal professional with expertise in local zoning and land use regulations should conduct this analysis.

Environmental Law Compliance Review

The purpose of an environmental law compliance review aims to identify potential environmental liabilities and assess the associated risks. It also helps to provide recommendations for remediation to mitigate those risks.

Tax Liens and Encumbrances Review

Tax liens and encumbrances affect the value of the property and the ability to transfer the title.

Tax liens affect the property’s ability to sell since the lienholder has a legal claim to the property and can prevent its transfer until the tax debt gets paid. Encumbrances are legal claims against a property that affects the use of the property. The parties must negotiate the transaction terms to address these issues if tax liens or encumbrances get discovered during due diligence.

Financial Due Diligence

Financial due diligence analyzes and verifies a company’s financial information before a merger, acquisition, or investment. The goal is to assess the financial health and performance of the target company, identify risks, and validate the accuracy of the financial information provided.

Review of Financial Statements and Projections

Financial statements summarize a company’s economic activities. Reviewing financial statements helps identify potential issues, such as inconsistencies or errors in financial data.

Market Analysis and Rent Roll Review

Market analysis involves examining the current and projected state of the real estate market in the appropriate location. The market analysis aims to understand the market dynamics and potential risks and opportunities for the investment.

On the other hand, a rent roll review involves analyzing the current and historical rental income and expenses for the property. It assesses the property’s current and potential rental income and identifies risks or opportunities for improving cash flow.

Review of Leases and Tenant Contracts

A thorough review of leases and tenant real estate contracts is critical in assessing the financial viability of a real estate investment. You must identify any potential risks associated with the tenants and evaluate the income stream generated by the property to ensure that it aligns with the investment objectives.

Evaluation of Capitalization Rates and Investment Returns

Capitalization rates and investment returns are critical in real estate and other asset-based investments. These metrics help investors to assess the risk and potential returns associated with a particular investment opportunity.

Environmental Due Diligence

Environmental due diligence evaluates the potential environmental liabilities associated with a property.

Site Assessment and Environmental Risk Analysis

Site assessment involves collecting and evaluating data on a property’s current and historical use and the site’s environmental conditions.

On the other hand, environmental risk analysis involves evaluating potential risks associated with a property or business, including environmental contamination and regulatory compliance.

Evaluation of Potential Hazardous Materials

Evaluation of hazardous materials that may be present on the property involves several steps. They include identifying potential sources of hazardous materials, assessing potential risks, and developing mitigation strategies.

Review of Previous Environmental Studies and Reports

Previous environmental studies and reports provide information about the site’s historical and current environmental conditions.

Analysis of Possible Environmental Liabilities

Environmental liabilities arise from various sources, such as hazardous waste disposal or environmental laws and regulations violations. It is critical to evaluate all potential ecological drawbacks during the due diligence to avoid any inconveniences in the transaction.

Property Condition Due Diligence

Property condition due diligence refers to evaluating a property’s physical condition before purchasing or leasing it.

Inspection of Physical Property and Building Systems

Physical property and building systems inspection involve a comprehensive assessment of the property’s physical condition, identifying defects that may affect its value, safety, or functionality.

Review of Maintenance and Repairs

Maintenance and repairs review refers to the ongoing actions to keep a property in good condition and extend its lifespan. It includes cleaning, landscaping, HVAC maintenance, structural repairs, and primary equipment replacement.

Analysis of Building Code Compliance

The analysis of building code compliance reviews building codes, regulations, and standards that apply to the property.

Evaluation of Building Life Cycle and Replacement Costs

The assessment of building life cycle and replacement costs analyzes the expected life cycle of a building, estimating the cost of maintaining and repairing it over a period of time and determining the cost of replacing it when it reaches the end of its useful life.

Key Takeaways

Due diligence is necessary for real estate investors and buyers before purchasing assets. It reduces risk and assists in establishing the market value of the property. Sign up to search for properties and get alerts of new property listings when they come on the market.

Contact a local eXp real estate agent for more information on due diligence and guarantee a thorough and complete investigation.

FAQs: What is due diligence in real estate

Here are frequently asked questions regarding due diligence in real estate.

What does due diligence include?

The due diligence involves a comprehensive analysis of the real estate investment opportunity.

How to do due diligence when buying a house?

To do due diligence, you should review property records, such as title deeds and surveys, and investigate potential liens, encumbrances, or zoning restrictions that may affect the property.

What is the difference between earnest and due diligence?

Earnest money deposit refers to funds a buyer pays a seller as a sign of their commitment to purchase a property or asset. On the other hand, due diligence refers to conducting a thorough investigation of a potential real estate investment before making a final decision.

Why is due diligence important in real estate?

Due diligence aims to identify potential risks or issues associated with the property or investment and ensure the buyer has all the necessary information to make an informed decision.

What are red flags in due diligence?

Some red flags in due diligence include legal or regulatory issues and inconsistent financial records. Things like unpaid taxes and dangerous structural issues that might not have been picked up by a property inspection are also red flags. Last but not least, it is important to investigate potential zoning violations or any soil contamination that could affect title registration.

Does appraisal happen during due diligence?

Yes, an appraisal is part of due diligence in certain types of transactions, particularly those involving the purchase or financing of real estate.

Is escrow the same as due diligence?

No, escrow and due diligence are not the same thing. Escrow is a financial arrangement in which a third party holds and manages funds or assets on behalf of two parties involved in a transaction until certain conditions get met.

On the other hand, due diligence is a process of investigation and analysis that a buyer or investor conducts on a business or asset before making a purchase or investment decision.

What issues are you looking out for in due diligence?

Issues to look out for in due diligence include legal, financial, environmental, and property condition due diligence.

What questions should you ask during due diligence?

When it comes to due diligence in real estate, it’s important to make sure nothing is overlooked. To help you with this, here are a few key questions that should always be asked during the process:

- What condition is the property in?

- What kind of market analysis do you have available?

- Are there any active or pending permits on the property?

- Does the property conform to local zoning regulations?

- How much necessary repairs or upgrades will need to be done?

- Is there an existing lease agreement?

- Also include queries on debts, financial performance, and compliance issues.

By covering these details and finding out the answers to all of your questions, you can ensure that your due diligence provides you with an informed overview of your potential investment.

Questions to ask include queries on debts, financial performance, and compliance issues.

What is a due diligence checklist?

Performing due diligence when investing in real estate begins with a due diligence checklist. This document serves as your safety net, helping you identify potential risks or issues that could affect the purchase or sale of a property.

Due diligence checklists usually cover the basics including background information on the property (run by title search and zoning reports) deciphering legal documents such as tax records and contracts, evaluating property condition and long-term costs (building inspections, insurance considerations), and other financial considerations like rent roll reviews and debt analysis.

To put it simply, by performing a thorough due diligence process you can steer clear of any barriers that may hinder a successful transaction.

What is the main purpose of due diligence?

The main purpose of due diligence in real estate is to identify any risks or liabilities associated with a particular investment or transaction. It’s an important part of the process, as it allows investors and buyers to have a clear understanding of what they’re getting into.

A thorough due diligence analysis can uncover hidden costs, provide insight into the true value of the property and reveal any potential violations that could jeopardize future plans. In sum, real estate due diligence ensures that all parties involved are adequately prepared for whatever may come their way and can make decisions armed with comprehensive and accurate information.