Paying off your mortgage early is a good idea in general, but for some people, there are better things you could do with your money instead. We’re going to go over how and why you should pay off your mortgage early, but also what you could do with your money instead.

Mortgage Review

Just to make sure we’re on the same page, let’s go over what actually makes up a mortgage and why paying it off early can help you in the long run. A mortgage is more than just a monthly payment. A mortgage is a bundle of payments that homeowners make in order to pay their lender for their loan. When you pay your mortgage, you’re paying off the interest for the loan, the principal of the loan, and usually real estate taxes, private mortgage insurance, and homeowners insurance. Let’s break each of these payments down.

The Interest

Interest is money paid to your lender in exchange for them loaning you however much money you needed to buy your house. In the first few years of paying your mortgage, interest will make up the majority of your payment. You pay more in interest initially so that the lender can make as much of their money back during the first few years of the loan and lower the risk that they’ll lose money if you default.

Interest is calculated on your principal. The bigger the principal, the higher the interest. Because you also pay off some of the principal with each mortgage payment, your interest payments will slowly decline too, because the amount of interest you pay is directly tied to the amount of principal you owe. Generally, it looks like this: at the beginning of a 30-year mortgage you pay mostly interest and not much principal, then eventually you pay half interest and half principal, and by the end of your mortgage term you’re paying almost all principal and not much interest.

The Principal

The principal is what really matters; it’s the heart of your mortgage. The principal is how much your lender lent you to buy your house. To figure out your principal, deduct your down payment from the price of your house. The higher your down payment, the less your principal, and the less your principal the less interest you pay.

Other Payments

Taxes and insurance are also factored into most people’s monthly mortgage payments. Typically their lenders will hold tax payments in escrow until the government collects them. Both private mortgage insurance and home insurance are meant, ultimately, to protect the lender. Private mortgage insurance protects the lender in the event you default on your loan.

Most of the time, you only pay PMI when your down payment is less than 20%. Home insurance will cover you if your house is damaged or robbed, but it will also cover the lender. Though it’s not legally required for you to have home insurance, most lenders would never give you a mortgage if you did not have home insurance. Why not?

Remember, your house is the collateral for your loan. So, what happens if you don’t pay your mortgage? If you can’t repay the loan, the lender will take the house. But if your house were to be damaged and lose value, then the collateral would be damaged and lose value, and the lender would be at great risk of losing money on their investment in you. Thus you pay homeowner’s insurance. If you decide to pay your home off, you can certainly opt for different insurance options but that’s not recommended.

So as you can see, a lot goes into a mortgage, and it should come as no surprise that many people wish to pay it off quickly and not have to worry about it. The question is, is it worth it?

Is It Worth Paying Off Your Mortgage Early?

To answer this, think about whether you want to save money in the future or make money now. If you work on paying off your mortgage early, you will save yourself tens of thousands of dollars in the long run, and we’ll get into how that works in a bit. But to save yourself a lot of money in the long run, you’ll have to spend more money now.

The argument against paying off your mortgage early goes like this: rather than spending money now to pay down your debt, invest that money into something that will bring you a profit now and in the future, or pay down debts with higher interest rates such as student loans, credit card debts, or car payments. All three options will result in more money in your bank account, they only differ in when that money will show up.

So do you want to spend more now to save more later, or spend more now to make more later? Are you an optimist willing to invest your money in securities or in lucrative markets like Charlotte Real Estate in the hopes those profits will overreach the amount you’d save if you were more cautious and instead paid off your mortgage early?

To simplify the questions you should ask. If you’re working and earning an income, the question is more about whether you can earn a higher interest on another investment. In the last decade or so the interest rates have been so low that it often didn’t make any sense to pay off your mortgage early.

When To Pay Off Your Mortgage Early

Before even asking how to pay off your mortgage early, make sure you’re in a position to do so. First, you need to make sure you have enough money set aside to afford the extra payments you’ll need to make each month. Aim to have enough savings to cover at least six months of house expenses and emergency expenses.

Make sure you don’t have other debts to worry about. Thanks to the long length of most mortgages, your monthly payments on your house will most likely be the lowest payments you have to worry about. If you’re also saddled with debt for a car, or college, or virtually any other payment plan, it’s best to pay those off first.

Make sure you don’t have to pay a prepayment penalty if you decide to pay off your mortgage early. Generally in the first few years of your mortgage term, your lender will have you pay a penalty if you make extra payments. They do this to save themselves on at least some of the losses on the money they would make had you just paid according to the plan. Call your lender to figure out what the penalty is and determine if you’re willing to pay it. If so, you’re all set to pay off your mortgage early.

How to Pay Off Your Mortgage Early

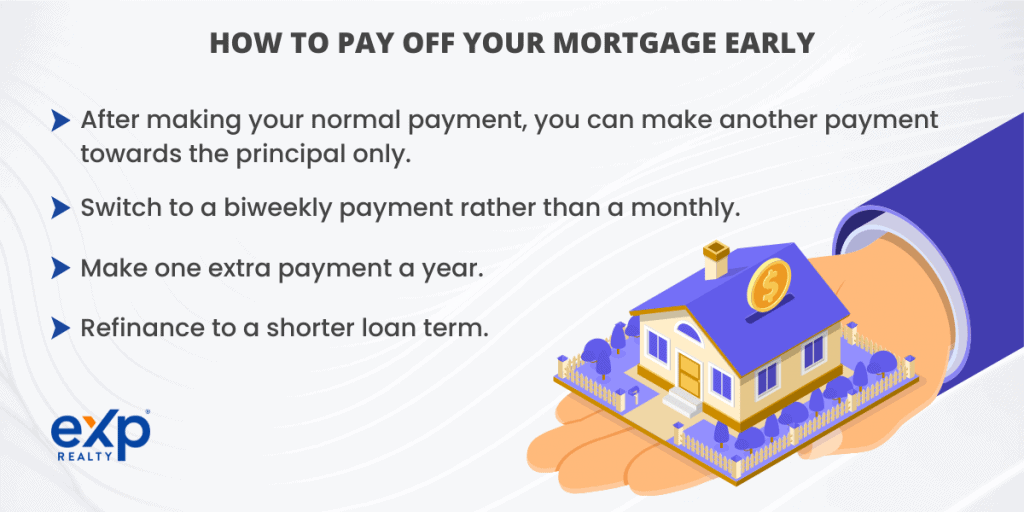

You are in control of how fast you pay off your mortgage. You do not need to spend hundreds of dollars extra each month to make a dramatic change. Each month, after making your normal payment, which at the beginning of the loan term will mostly be interest and not much principal, you can make another payment towards the principal only. When you do this make sure it’s clear to the lender that the payment is towards the principal. Remember, the principal matters most. The more you cut it down, the less you’ll pay in interest. Even an extra 50 dollars a month towards the principal of your loan can make a difference in years of payments.

You can also switch to a biweekly payment rather than a monthly one. With a monthly payment plan, you make 12 payments a year whereas with the biweekly you make 26. That’s the equivalent of a whole extra month of payments in one year, which will take 2.5 years off your mortgage payments. BUT you usually have to pay a fee to get into a biweekly payment.

If you’re worried about prepayment penalties and don’t want to make that a monthly hit against your expenses, just make one extra payment a year. Even one extra payment a year will shorten a thirty-year loan by 2.5 years. This is about the same outcome as the biweekly payment plan, without having to pay the fee, though you still may be subject to prepayment penalties.

Finally, you can refinance to a shorter loan term. You will save much more money on interest payments and avoid payment penalties, as well as reduce the amount of time you’re in debt if debt is something you worry about. The catch is that your monthly payments will be higher than if you kept your longer-term loan. Do the math first and see if you can cover the extra expenses. If you can, refinancing your loan is one of the most straightforward ways to pay off your mortgage early.

When NOT to pay off your mortgage early

Hypothetical, investment rates and money management aside, there is one instance where paying off your mortgage could be detrimental. If you are retired and on a fixed income, you might like to knock out the mortgage so you don’t have anything to worry about. However, in order to do so you might have to access your retirement funds. Doing so could put you at risk. If you’re on a fixed income you’ll have more disposable income each month but your retirement money won’t be working for you anymore. In addition, what if you need a large sum of money for medical bills or some other thing? The money will be tied up to the home now. Now, here’s the catch. Since you’re unemployed, most lenders won’t give you a loan. Instead, you’d likely have to opt for a less-favorable reverse mortgage to access the funds.

Paying Off Your Mortgage Early

Whether or not it’s worth it to pay off your mortgage early depends entirely on your financial priorities. Paying it off early will always save you money in the long run and cost you money in the short run. The real question to answer is, could that extra money you’d spend be spent either on paying off costlier debts or invested into more profitable ventures? Think it over, and if you’re on a house hunt, get in touch with an agent and work it out ahead of time how you want to handle your mortgage.